Should robots be taxed for stealing jobs?

If death and taxes are the only two things that a person can count on, should the latter apply to robots as well, as they take over jobs traditionally done by humans?

That’s the argument put forward by University of Geneva professor and tax lawyer Xavier Oberson.

Oberson argues that as robots take over more and more jobs – particularly in the industry and service sectors – there will be a rise in unemployment and a corresponding drop in tax and social security receipts by governments all over the world. He believes that imposing a tax on work done by robots could help offset these losses.

Logistically, he says this could be managed by creating a “legal entity” representing robots, just as is done today for corporations.

“You’d need a global approach – this isn’t something one country could introduce alone. There could be competition issues, and of course, there are a lot of legal questions,” Oberson tells swissinfo.ch.

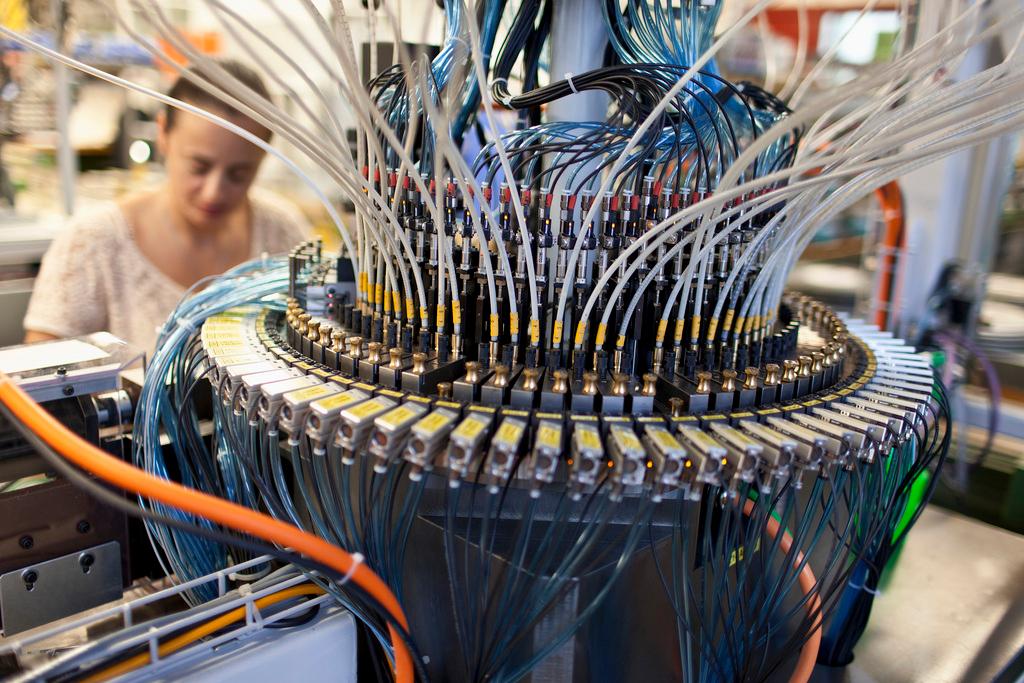

One of the most pressing legal questions, of course, is: how do you define a robot? Does it have to walk and talk, or does an advanced computer count?

“We should be clear on the concept, and there should be objective reasons to tax robots vis-à-vis other machines,” Oberson says. “I would try to focus on the big differences between a robot with artificial intelligence and other machines: autonomy, and the ability to evolve, make decisions, and learn from past experiences.”

Replaced by machines?

As for the tax burden borne by robot-employing companies, Oberson argues that this would be offset by having to make fewer social security payments – especially since a single robot could be expected to replace more than one human worker. He suggests that funds generated by such a tax could go toward financing social security, as well as training for the unemployed.

According to consulting firm Deloitte SwitzerlandExternal link, in principle, 50% of current Swiss jobs could indeed be lost to automation in the coming years. But actual employment figures show that over the last quarter century, more jobs have been created due to automation than have been lost.

At the same time, jobs with a low risk of being replaced by automation have grown significantly, while jobs with a high risk have increased more slowly, or even decreased. Jobs with a low risk of replacement by machines tend to involve creativity, social interaction and customer service. Overall, Deloitte estimates that some 270,000 new jobsExternal link will be created in Switzerland by 2025 thanks to automation.

But while Oberson agrees that robots can create some new positions, he argues that the number of jobs lost to them is likely to be even larger in the future – particularly with the rise of artificial intelligence, which will allow robots to learn and adapt to new situations.

He says that in addition to manufacturing, which is already highly automated, service jobs and even medical image analysis and legal researchExternal link are likely to be handled increasingly by robots.

Indeed, in February, BloombergExternal link reported that traditionally high salaries coupled with high costs associated with the strong franc are increasingly forcing Swiss companies like Firmenich and Ricola to hire automated workers rather than human ones.

Divided opinion

Oberson’s proposition may sound bizarre, but the idea that managing robotic workers – especially those imbued with artificial intelligence – requires the reassessment and possible revision of current social and labour policies is gaining traction.

At the end of 2016, the World Economic Forum rated artificial intelligence and robotics as the number one emerging technologyExternal link in need of better governance. Last month, French politician Benoît HamonExternal link proposed a robot tax as a method of funding a universal basic income. And in February, Bill Gates himself expressed his support for a robot tax in an interview with Quartz magazineExternal link, as a means to moderate the rapid automation of the workforce.

Oberson says that it’s important for politicians and lawmakers to begin discussing these issues now, before robotic replacement of humans in the workforce becomes more widespread than it is today – which he says could happen suddenly and rapidly.

But not everyone is convinced.

“Robotic manipulators have been replacing humans on factory floors around the world to produce better goods, in larger numbers at more affordable prices, for the past 50 years. There’s no reason why more advanced robots should be treated differently from a tax perspective,” says Dario FloreanoExternal link, Director of the Laboratory of Intelligent Systems at the Swiss Federal Institute of Technology in Lausanne (EPFL) and member of the World Economic Forum Global Agenda Council on Robotics and Smart Devices.

Thomas Pletscher, head of competition and regulation at the Swiss Business Federation, Economiesuisse, says that taxing specific means of production like robots could have a “distorting effect” on business.

“Value created by robots is included in the taxation of corporate income just like all other means of production. A special tax on robots would be harmful to innovation and thus for Switzerland as a whole,” he tells swissinfo.ch.

Ivo Zimmermann is head of communications at SwissmemExternal link, a lobby group representing Swiss manufacturers. He adds that taxing robots could also stunt new business opportunities.

“Taxing robots, in our view, would negatively affect the competitiveness of Swiss industry. This digitisation we see now is also about new business models, and we think that Swiss industry and economy must seize the chances that come with these developments.”

Still, Oberson believes that a method of taxation could be developed that would not place an unfair burden on companies – such as a value-added tax on services provided by robots, for example – nor threaten Switzerland’s future economic growth.

Speaking to a packed auditorium at the University of Geneva on February 21, Oberson said: “The use of robots presents positive aspects – a new model of society is drawn. Taxation must not be conceived as a brake on innovation.”

The following week, Swiss parliamentarian Mathias Reynard invited the government to consider a tax on robots in Switzerland, noting that such a scheme appeared to be a “suitable solution” to anticipated job losses, which “would ensure the transition from [the] current economy to an increasingly automated economy”.

European Parliament joins the debate

In January, the European Parliament Legal Affairs Committee called on the European Commission to develop a “robust European legal frameworkExternal link” to regulate the growing impact of robots – including driverless cars – on society. On February 16, the European Parliament voted to adopt the reportExternal link – which recommends giving robots the legal status of “electronic persons responsible for making good any damage they may cause” – but rejected a specific proposal for a robot tax.

What do you think: should companies pay a tax on using robots that replace human workers? Share your views in the comments!

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.