Insurance

Insurance companies in Switzerland offer policies for everything from mandatory health coverage to vehicles and personal liability protection.

Supplementary insurance can add additional coverage to standard policies for many scenarios, including the right to a private room in a hospital, more robust accident policies and coverage that remains valid when overseas.

In addition, special groups often offer their own insurance to cover potential accidents that could befall their members. For instance, outdoor enthusiasts can purchase a policy to cover the costs of a helicopter rescue from the Alps.

More

Why there are 250,000 different prices for one health insurance

Health

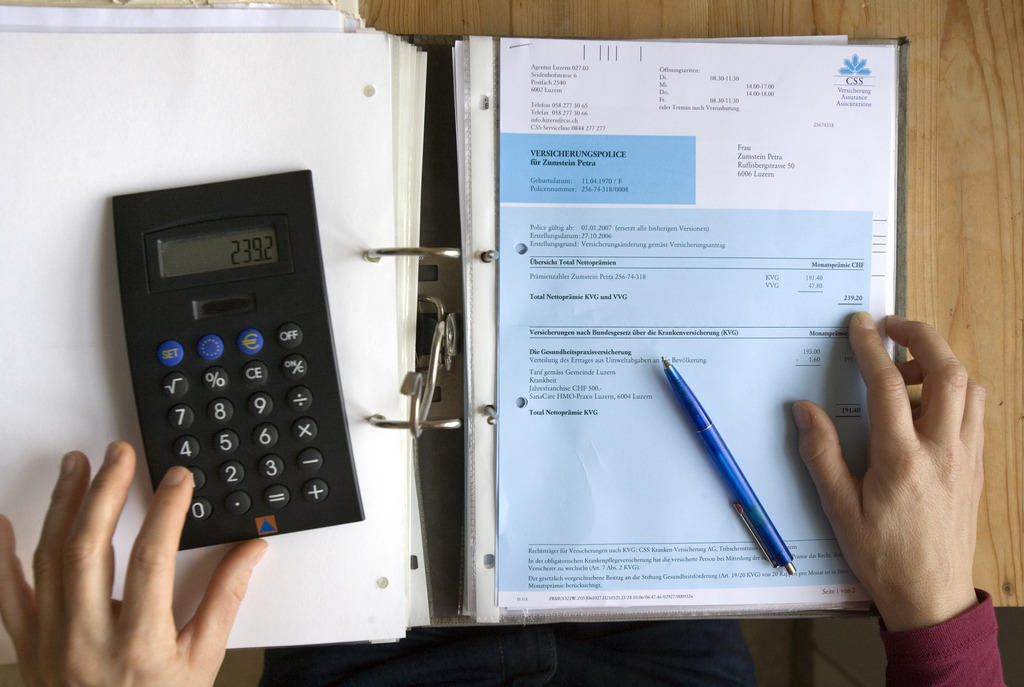

By law every resident in Switzerland must purchase basic health insurance, which covers many conditions, from childbirth to doctor visits and serious illnesses.

All health insurance companies must offer the same benefits covered under the basic insurance policy. Supplementary plans are optional and will cost more. For more on the benefits covered by law please see this page of the Federal Office of Public Health.External link

Many people opt to buy supplementary coverage that can apply to just about any aspect of health care, including dental care, illness while abroad or use of a private room in hospital.

Several insurance models exist, including HMO, general practitioner, or Telmed, which require patients to follow certain procedures when seeking health care in exchange for reduced premiums.

Those just arriving to live in Switzerland have three months from the time of arrival to purchase a policy.

More

Living and working in Switzerland

Policies are offered for adults with deductibles ranging from CHF300 to CHF2,500 ($298-$2,480) and for children from nothing to CHF600. Regardless of their deductible, a person seeking health care is required to pay 10% of health costs, up to CHF700 per year. Coverage may be limited to the canton where the policy holder lives, with exceptions for emergencies.

Basic insurance does not necessarily cover injuries suffered in an accident and “accident insurance” must be purchased separately. Anyone who works for the same employer for at least eight hours per week is automatically covered – including for accidents outside work – and does not need to purchase accident insurance.

The private website comparis.chExternal link is a good source for finding quotes on various policies from numerous providers. It also provides a calculator for figuring out a person’s optimal deductible rate.

Personal third-party liability/Household insurance

Many Swiss and foreign residents alike purchase optional private/household insurance to cover themselves in the case of fire or water damage as well as theft. Be sure to buy a policy appropriate for the value of all goods. This type of insurance is often required of tenants by landlords.

Personal liability insurance is sometimes bundled with household insurance and covers the policyholder in the event of damage to a third party. Family versions of personal liability insurance are available. The internet portal comparis.chExternal link is a good starting point for finding out more about these types of policies.

In certain Swiss cantons, notably Bern and VaudExternal link, property insurance against fire is compulsoryExternal link for owners and for tenants.

Car insurance

Anyone who owns a car, motorcycle or motorised scooter must be covered by insurance. Optional policies can be purchased to cover costs of damages to the holder’s own car as well as any occupants.

The internet portal comparis.chExternal link is a good starting point for comparing car insurance offers.

Members of the Mobility External linkcar sharing service are covered by the company’s own third-party, comprehensive and passenger insurance.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.