UBS shareholders set sights on former bosses

Lawyers representing disgruntled UBS shareholders are threatening to sue the bank’s former executives for alleged malpractices that led to massive losses.

Former UBS chairman Marcel Ospel heads a list of targets for potential lawsuits following the bank’s fall from grace. The chances of legal action were boosted in April when shareholders voted against absolving 2007 executives from blame.

UBS was Europe’s worst victim of the subprime mortgage collapse, writing down some $50 billion (SFr53 billion) while share prices crashed from a high of SFr75 to a low of SFr8 in the space of two years.

The dramatic collapse led to Ospel and many other executives either stepping down or being sacked. Despite many calls to bring these former executives to account, UBS said in December last year that it would not be bringing any legal charges.

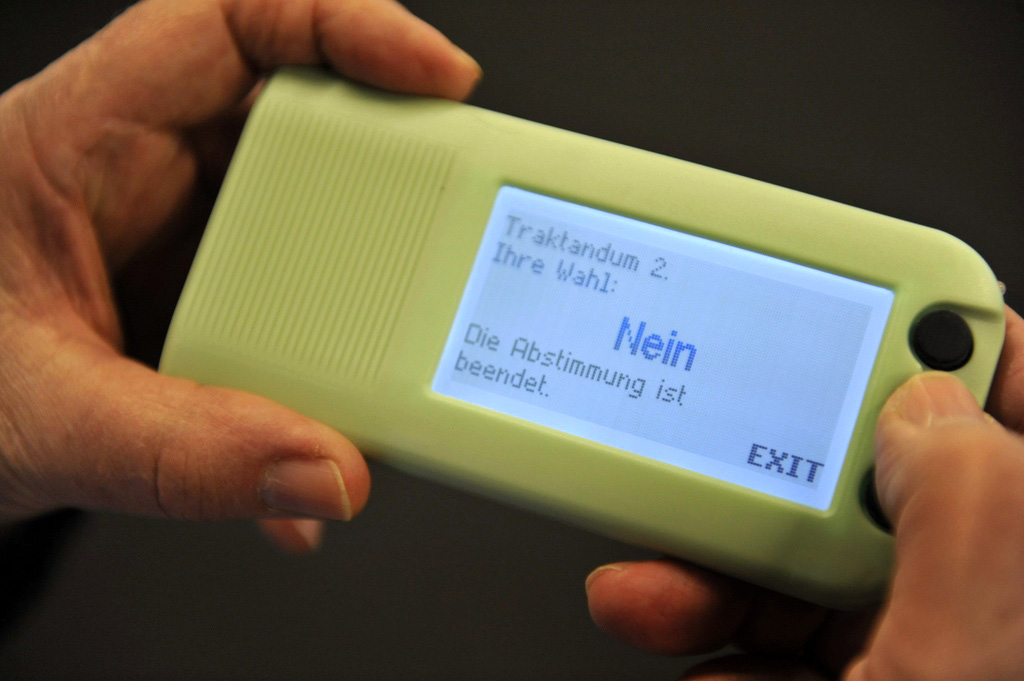

Angry shareholders partially rebelled against a recommendation from the bank to formally discharge ex-bosses at April’s annual general meeting. Discharge was granted for the years 2008 and 2009, but shareholders voted against similar action for the year 2007.

This means that shareholders who wish to pursue private legal claims have until October 14 to sue for damages relating to 2008 and 2009 but five years to consider bring action concerning the events of 2007.

Large investors bide time

Shareholder activist groups, the Ethos Foundation and Actares, have demanded that the current UBS board reconsider its refusal to bring legal charges against Ospel and others.

They have been joined by Belgian-based specialist corporate damages recovery firm Deminor which is representing retail and institutional clients. Zurich law firm Fischer & Partner, which is currently pursuing a compensation claim against Credit Suisse for losses relating to Lehman products, also has UBS shareholder clients.

Deminor told swissinfo.ch that around 200 small UBS shareholders have registered complaints on their website. In addition, it is also talking to several large institutional clients – typically hedge funds and pension groups.

“Experience has shown that you have to get the retail [small, independent] investors involved first. If retail investors are pushing with popular pressure then it gives greater incentive to large institutional investors to join in,” said Deminor spokesman Edouard Fremault.

Deminor has given UBS until August 15 to press its own legal action against former executives, after which it is threatening to support private claims. These would be on the grounds that UBS exercised insufficient risk management procedures and let shareholders down by not revealing the full extent of its subprime exposure in a timely manner.

“Our own investigations have shown that UBS failed to disclose the real subprime exposure of the company in 2007. Share prices fell dramatically when the real situation was revealed to the public later,” said Fremault.

Huge costs

UBS told swissinfo.ch that it is reviewing its December decision not to prosecute former board members. But this review was sparked by a Swiss parliamentary standing committee recommendation – which sets a deadline of the end of this year to make a decision – and not the AGM shareholder rebellion.

UBS would not comment on the likelihood of a reversal in position, but the bank is coming under increasing political pressure to re-think.

Experts believe that action taken by UBS against former executives would represent the best chance of success for shareholders. Quite apart from the fact the bank holds most of the key evidence, Deminor estimates legal costs could reach SFr250 million to claim compensation for the SFr50 billion that shareholders lost between 2007 and 2009.

Aside from the costs involved, legal action for failed corporate strategies have a poor track record in Switzerland.

An attempt by canton Zurich prosecutors to sue former bosses of failed national airline Swissair three years ago failed to land a single conviction while racking up a SFr5 million legal bill. This time around, Zurich prosecutors have decided against pursuing action in the UBS case.

However, that has not stopped some former UBS executives from feeling uncomfortable under the strain of calls for their heads. Peter Kurer, former general counsel and chairman at the bank, told the NZZ am Sonntag newspaper recently that political demands for legal action represented a form of “lynch justice”.

Matthew Allen in Zurich, swissinfo.ch

UBS shareholders refused to discharge bank executives during 2007, therefore signaling that they held them accountable for their actions that led to the bank’s demise.

These main individuals include Marcel Ospel (chairman until April 2008), Peter Kurer (general counsel and then chairman from April 2008-April 2009), Peter Wuffli (CEO until July 2007) and Marcel Rohner (CEO July 2007-Februray 2009).

Huw Jenkins (investment bank CEO), Clive Standish (chief financial officer until October 2007) and Marco Suter (chief financial officer October 2007-August 2008) are also potentially in the frame for civil suits.

However, shareholders can afford to wait and gather evidence for five years before opening a legal action against any UBS executive who was in place in 2007.

The decision of the UBS AGM to discharge executives who were in office during the years 2008 and 2009 means claims must be filed against these individuals by October 14 this year – six months after the AGM vote.

Of the chief suspects, Ospel, Kurer and Rohner could face an early lawsuit as they were all in office during 2008.

The grounds for civil lawsuits could include: failure to exercise proper risk management, failure to declare subprime exposure in a timely manner.

UBS was also damaged by a tax evasion scandal in the United States and it could be argued that the bank’s share price was hit by a court conviction and subsequently being forced to reveal confidential client data to the US authorities.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.