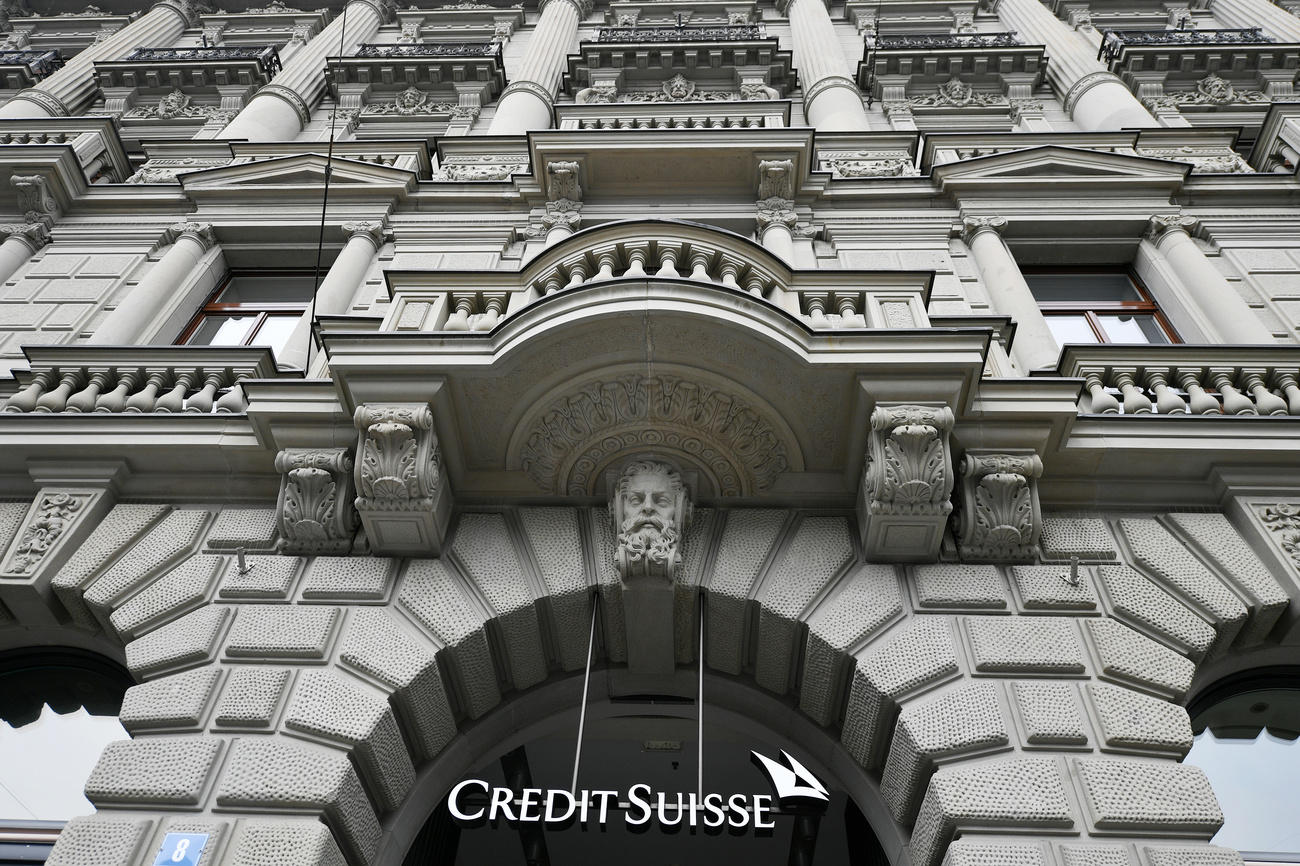

Credit Suisse braced for ‘spygate’ reputational fallout

The usually discrete world of Swiss private banking has been shaken by spying revelations at Credit Suisse, the country’s second largest wealth manager. Chairman Urs Rohner has acknowledged that the sordid affair has damaged the reputation of the bank and the Swiss financial centre.

Despite Rohner’s profuse apologies, and the bank pinning the blame squarely on the shoulders of a single employee, the question remains of how much damage the sequence of events (see box below) has inflicted on Credit Suisse.

Convincing the world’s wealthiest people to allow you to manage their assets requires high levels of trust, discretion and sophistication. This is not achieved by lurid global headlines detailing mistrust between executives, petty personal feuding and crude surveillance tactics. Credit Suisse may dispute some details, but the bank has been powerless to prevent the unedifying sight of its dirty laundry being aired in public.

Evidence of the board of directors failing to control executives and being blindsided by the actions of one over-zealous top manager can also hardly help inspire confidence.

The value of private banking to Credit Suisse cannot be over-estimated. The International Wealth Management division (dominated by private banking) contributed CHF1.7 billion ($1.7 billion) of reported pre-tax income to the group total of CHF3.4 billion last year.

Long-term damage?

Credit Suisse’s internal report appears to limit the damage to some degree. The bank’s Chief Operations Officer has admitted to acting alone and has resigned. And, tragically, it appears that an intermediary he used to set up the surveillance on former employee Iqbal Khan has taken his own life.

CEO Tidjane Thiam, Rohner and other executives and directors have been spared by the investigation. One large shareholder of the bank had voiced the concern of serious damage being done had any of the top tier of management been forced to step down.

Credit Suisse’s share priceExternal link has suffered since the first media reportExternal link of the scandal, but at the time of publication of this article, it has hardly crashed.

Credit Suisse and other banks, both in Switzerland and abroad, have endured numerous scandals in recent years – at times involving criminal activity and resulting in the loss of more high-profile executives.

The latest scandal is no doubt highly embarrassing and further tarnishes Credit Suisse’s reputation. The apparent suicide of one of the actors in this affair is distressing. But unless further revelations come to light (police are also investigating the matter), the bank may not have been holed below the waterline.

July 1: Credit Suisse announces Iqbal Khan will be stepping down as head of its International Wealth Management unit, a post he has held for nearly four years. He is sent on gardening leave and on August 29 it is announced he will join rival bank UBS.

After his departure from Credit Suisse is announced COO Pierre-Olivier Bouee orders a private security firm to conduct surveillance on Khan to check that he is not inducing clients to move to UBS.

September 17: Khan notices he is being followed and confronts a private detective in the streets of Zurich. Three days later the incident appears in an article written by financial online media portal Inside Paradeplatz. Khan files a criminal complaint with police.

September 24: Credit Suisse asks a Swiss law firm to conduct an investigation into the events.

Media coverage intensifies with reports of a previous private altercation between Thiam and Khan, who are neighbours in the same well-heeled district. The argument is reported to be about trees being planted between the two properties and is said to have been heated.

September 30: It is reported that a contractor who hired detectives to follow Khan has taken his own life in connection with the events.

October 1: Credit Suisse announces the results of the investigation, finding Bouee solely responsible. Credit Suisse apologises to staff, shareholders, customers and to Khan while appointing James B. Walker to replace Bouee.

On the same day, Khan takes up his new post at UBS.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.