Chinese dragon hobbled by cultural differences

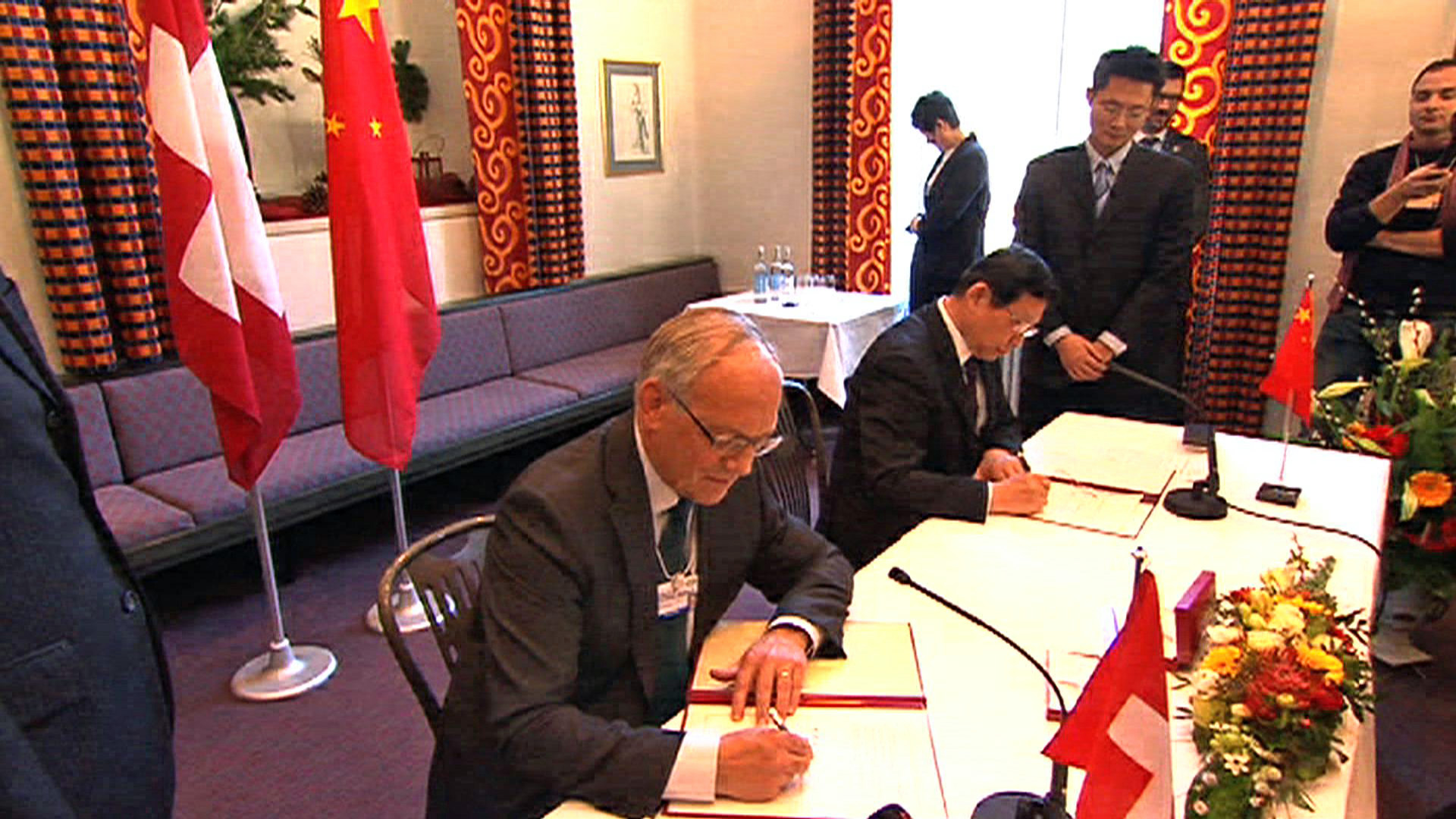

The free trade deal being signed Saturday between Bern and Beijing will bring more Chinese companies to Switzerland. Yet Chinese businessmen already here struggle with cultural problems and unfamiliarity with the local economic environment.

Hankou Jingwu is a food manufacturer with headquarters in Wuhan, central China. Its production is geared to the local market, but it is now looking at Switzerland. According to Juan Wu, an economist at the ZHAW technical college in Zurich, this is a significant example of growing Chinese interest in the country.

“The company would like to open a branch in Switzerland and produce to Swiss standards. Then it could tell Chinese clients that its products are high-quality. That would increase sales, especially when you think of the recurring food scandals [in China],” Juan Wu told swissinfo.ch.

“The interesting aspect is that this is not a large conglomerate headquartered in Beijing or Shanghai. If its management is looking towards Switzerland, others will be looking too.”

Juan Wu believes the free trade agreement (FTA) will favour the establishment of new companies. This view is shared by Yuming Yang, a Chinese businessman who has been many years in Switzerland, and who emphasises that “the ‘made in Switzerland’ brand has a great reputation in China.”

The agreement will reduce customs duties for some categories of products (see infobox), which will have a positive effect on bilateral trade. “This free trade agreement will favour exports going both ways. And trade is what goes before investment”, says Philippe Monnier, director of the regional economic marketing organisation Greater Geneva Berne Area (GGBA).

More

Swiss exports set for boost from China

In Switzerland to sell to China

Chinese companies in Switzerland now number between 70 and 80, reports Ernst & Young. In 2005 it counted only five. The Chinese have entered the Swiss market by way of mergers and acquisitions, branch plants, or share purchases.

What attracts these companies is “our grey matter and Swiss brands”, Marc Laperrouza, a specialist in China and emerging markets at Lausanne University and Federal Institute of Technology, told swissinfo.ch.

“The Chinese are interested in new technologies, and also Swiss quality and professionalism,” adds Yuming Yang, who in 2000 acquired Nouvelle Onivia, a manufacturer of watch components at Porrentruy in canton Jura.

“We do not see any tendency to concentrate in one area. Chinese companies are present in several cantons and in different sectors: watchmaking, consulting, telecommunications, solar energy, and so on”, notes Juan Wu. She has coauthored a study to be published shortly on Chinese companies in Switzerland.

China is Switzerland’s most important trading partner after the European Union and the US.

Since 2002, Switzerland has had a positive trade balance with China. In 2011, Swiss exports totalled CHF8.84 billion, against CHF6.31 billion of Chinese imports.

Provisional data for 2012, based on a new method of calculation, suggest that there are now CHF7.82 billion worth of exports and CHF10.28 billion worth of imports.

From Switzerland, the exports are mostly watches and clocks, machinery, pharmaceuticals and precision tools.

From China come imports of machinery, textiles and clothing, watches and basic chemical products.

Mentalities differ

The ZHAW economist interviewed managers and staff of twenty Chinese companies in Switzerland, to ask them about the challenges they face. The results were surprising in some respects, she says. “The majority of Chinese business people are grappling with cultural misunderstandings between Chinese and Swiss staff. These conflicts are due not so much to language barriers, as is often thought, but differences in mentality.”

In Switzerland, explains the researcher, for example, it is usual to say what one thinks and deal with problems openly. In China there is a tendency to be more indirect, hoping that the other party will get the message. “These different ways of communicating may lead to misunderstandings and cause unintended offence,” she says.

Wage differences between staff members are another cause of friction. Often, the study found, Chinese staff earn a lot less than their Swiss or European colleagues.

“Chinese management is not always compatible with Europe”, agrees Marc Laperrouza. This goes some way to explain the lack of success of some takeovers of European companies by Chinese, he believes.

Switzerland is the second European country to conclude a free trade agreement with China, to be signed July 6, 2013. Iceland lead the way in April.

The agreement means a reduction of duties on a range of products. Direct tax on goods will be abolished for 84% of Swiss exports, says Chinese trade minister Yu Jianhua. In the other direction, duties will be scrapped for 99.7% of Chinese exports.

Currently, Chinese customs duties are about 8.9% on industrial products and 15.2% on agricultural goods, says the Swiss economics ministry.

Among the items that will no longer be subject to duty are measurement instruments, hydraulic turbines, machinery, pharmaceuticals, and watches and clocks.

Swiss Economics Minister Johann Schneider-Ammann emphasises that Switzerland has made no concessions in the sensitive agricultural sector. He also claims there has been progress in human rights and the rule of law.

Getting advice from friends

Cultural misunderstandings also arise from the fact that the Swiss business environment seems so alien to Chinese business people. “None of my Chinese colleagues really know it,” says Yuming Yang, who is a former consultant with the Swatch group.

Switzerland is famed for its symbolic goods, like chocolate and watches, and enjoys a great reputation among Chinese investors in general, says Andreas Bodenmann, a China specialist at Ernst & Young, “but it is not known as a place for production or a business environment.”

When a Chinese company wants to set up an office or a regional headquarters in Europe, it thinks first of Germany, adds Philippe Monnier. In the city of Hamburg alone there are 500 Chinese companies.

“We need to work on our image, because in China we are not known as a country where one can do business – even if conditions are better than in Germany or France,” says Monnier, quoting advantages in terms of tax, political and social stability, central position in Europe and language abilities of staff.

The problem, Juan Wu believes, is that Chinese managers are likely to get their information from personal acquaintances, friends or in-house contacts. “This is a kind of non-professional advice. Our study found that only 5 per cent of interviewees made use of information from OSEC,” the national export agency, now called Switzerland Global Enterprise.

“Many have come here sight unseen. They think they know what it is like in Switzerland, but then they find they were wrong,” explains Wu.

The risk for the Chinese is to end up like the Japanese, warns businessman Yuming Yang. “Thirty or 40 years ago they invested and made acquisitions here in Switzerland. But where are those Japanese today? Only maybe 10 per cent of them are left. The reason is cultural differences. In Switzerland there is not the culture of personal contacts, and the government won’t help you. The only thing that can help you is your product.”

(Translated from Italian by Terence MacNamee)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.