Chinese “Eldorado” helps boost watch industry

The Swiss watch industry is ticking along nicely, enjoying a period of renewed confidence thanks to buoyant demand for luxury timepieces in Asia, especially China.

There were lots of smiling faces in Geneva this week at the 21st Salon International de la Haute Horlogerie (SIHH) and the Geneva Time Exhibition, which features small independent brands.

“I feel much more confident and serene this year,” Fabienne Lupo, SIHH director, told swissinfo.ch.

2010 was a “spectacular” year for the Swiss watch industry with exports increasing by almost 30 per cent in November compared with the previous year, worth SFr14.6 billion ($15.1 billion). When December’s figures are released soon the total is expected to come close to the 2008 record – SFr17 billion.

“I’m very satisfied to see the evolution,” said Jean-Daniel Pasche, head of the Federation of the Swiss Watch Industry. “What is striking is the speed and size of the cycles.”

Recession hit in 2009 with a 24 per cent drop in exports and the loss of some 4,000 jobs in a sector that employs 53,000.

“But structurally we were not that affected, and as soon as the markets took off again the sector took advantage via its distribution networks and available products,” said Pasche.

Expectations are high for 2011.

“Export growth is looking favourable but we are concerned about the strength of the Swiss franc which can affect competitiveness and margins,” said the federation president.

Asian explosion

“The forecast is positive thanks to new territories in Asia,” said Lupo. “China has really woken up; the Chinese buy Swiss watches not just at home but from around the world.”

Exports to Asian markets shot up last year: +55 per cent to China, +46 per cent to Hong Kong and +37 per cent to Singapore.

On Monday the Geneva-based luxury giant Richemont, which organises the SIHH, posted a 33 per cent sales increase for its third quarter ending on December 31, 2010.

Sales in the Asia-Pacific region surged 57 per cent to $1.03 billion as Chinese customers bought products like Cartier, Piaget and Vacheron Constantin luxury watches. This compares with a growth of 25 per cent a year earlier, making Asia-Pacific the company’s fastest-growing region.

Analysts say the region is on course to overtake Europe as the company’s largest.

Hungry for luxury

“China has become a bit of an Eldorado for the world of luxury products,” Christian Barbier, sales director for watchmaker Parmigiani, told swissinfo.ch.

“The Chinese are hungry for luxury consumer products that represent certain values; it’s the same phenomenon as in Russia ten years ago.”

According to KPMG, China is now the second-largest luxury market in the world, after Japan.

A report published in August 2010 by the consultancy firm said the Chinese “super rich” segment had continued to grow despite the recent global economic turbulence.

“While younger professionals and other aspiring consumers may have struggled to command higher salaries over the past year, privately-owned enterprises are increasingly surpassing the former state-owned enterprises as generators of wealth, creating a new consuming elite,” it stated.

Internal demand came to life in China at the end of 2008 and lots of watch brands switched the focus of their marketing strategies in 2009 and 2010 from regions like North America, said Barbier.

“Asia, and especially China, has become a short-term objective for fast growth,” he noted, while acknowledging that competition in the high-end segment there was tough.

“In the next five years certain places will be taken and the entry barrier will become much higher,” said the sales director.

Eggs in baskets

Experts say brands which started investing there ten years ago have a clear headstart and are starting to reap the benefits.

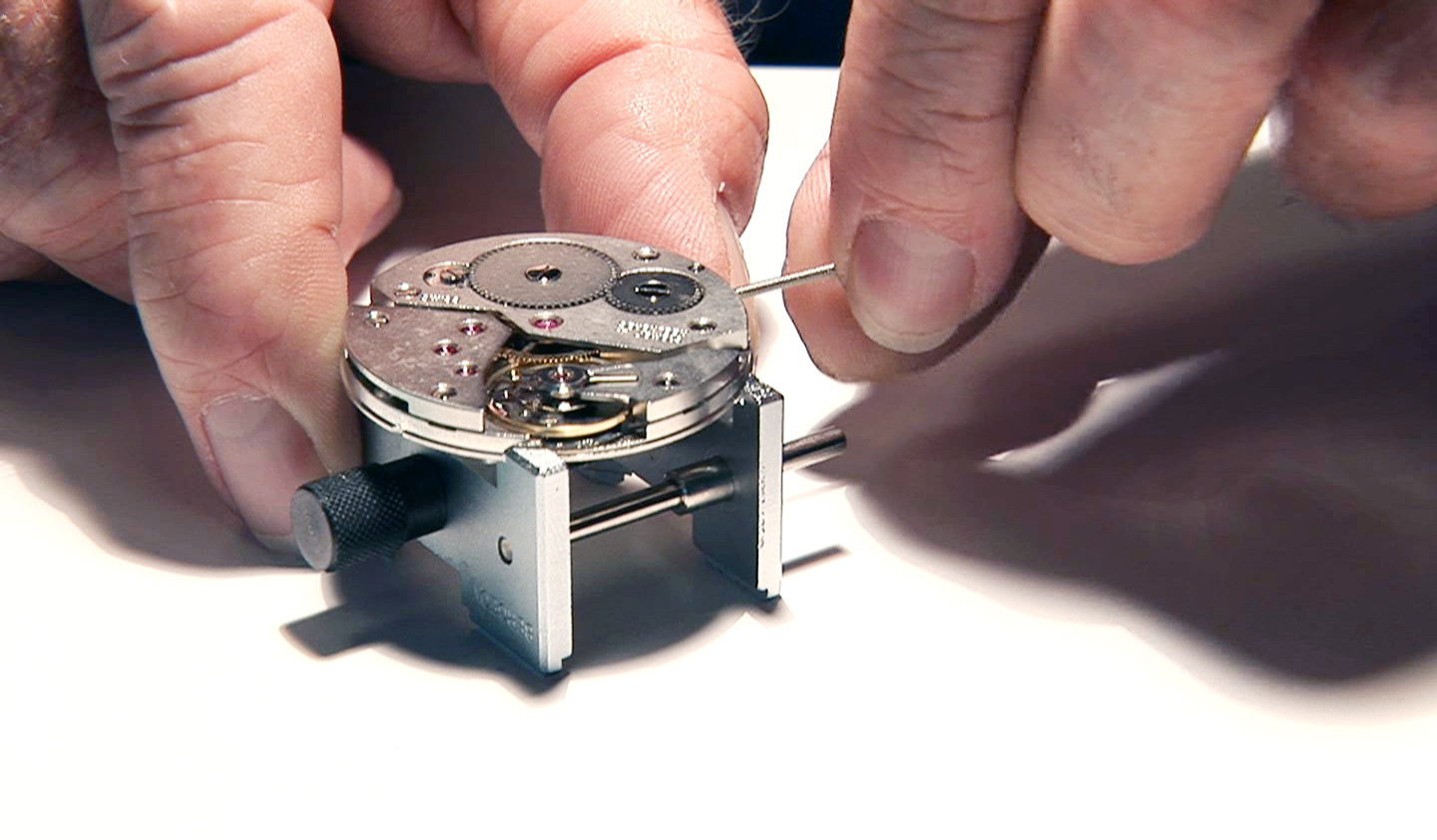

Parmigiani, which started business in 1986 and employs 500 staff who produce 5,000 luxury watches annually, is conscious of the need not to put all its eggs in the Chinese basket, however.

It has therefore developed three sales platforms – at Fleurier in Switzerland, Miami, and Hong Kong – and is maintaining a focus on the “very important” US market.

Barbier’s cautious position mirrors that of Bernard Fornas, the chief executive officer for Cartier, who warned on Tuesday of overdependence on the Chinese market.

“We have implemented complementary strategies in other regions. We are in no way neglecting our other markets,” Fornas told Reuters.

Cartier, which already has 34 shops in China, said it would add an extra 6-7 shops this year and would open another 15-20 shops in the rest of the world, in cities such as Abu Dhabi.

The 21st Salon International de la Haute Horlogerie (SIHH) is taking place from January 17-21 at the Palexpo exhibition hall in Geneva. The SIHH remains a private fair for professionals from around the world.

The brands presenting their new models are: A. Lange & Söhne, Alfred Dunhill, Audemars Piguet, Baume & Mercier, Cartier, Girard-Perregaux, Greubel Forsey, IWC, Jaeger-LeCoultre, JeanRichard, Montblanc, Officine Panerai, Parmigiani Fleurier, Piaget, Ralph Lauren Watch and Jewelry Co, Richard Mille, Roger Dubuis, Vacheron Constantin and Van Cleef & Arpels.

The Geneva Time Exhibition is taking place from January 16-21 at the Geneva International Conference Centre. The exhibition is also a private fair for professionals from around the world. Some 60 small independent watch brands are on show, mostly from Switzerland. Watch prices average around SFr30,000.

The world’s biggest watch and jewellery fair – Baselworld – will take place in Basel from March 24-31.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.