Climate ‘code red’ jolts the business world

From scorching heat and smoky skies to thunderous rain, hail and flooding, it’s hard not to fear summer fun won’t be the same in the future.

The Intergovernmental Panel on Climate Change (IPCC) sounded the alarm on Monday predicting a quicker onset of global warming. United Nations Secretary-General Antonio Guterres called it a “code red” for humanity. The report doesn’t mince words when it comes to what is causing climate change, and what it means for extreme weather events.

There’s plenty of blame to go around. In Switzerland, climate activists camped out in Zurich last week, staged demos and blocked entrances to UBS and Credit Suisse, reminding the public that behind every climate offender are some deep pockets. The message on the banner as they walked through Bern on Friday was blunt – “Stop the dirty business”.

Climate demo arrives in Bern. pic.twitter.com/DS5Q3RYLZzExternal link

— Jessica Davis Pluess (@JPluess) August 6, 2021External link

If this summer is any sign, we can’t wait until 2050 for big banks and companies to achieve their net zero targets. Some 80% of the biggest Swiss banks and asset management firms still have coal companies in their portfolios.

Meanwhile, regulators are cracking down on creative climate accounting. As my colleague Matt Allen wrote in early July, the Swiss financial regulator FINMA will start requiring banks to disclose the methods behind their climate risk numbers, to prevent the public from being “misled”.

As governments tally up the human and financial losses of this summer, companies and banks may face bigger problems than activists at their doorstep. Armed with the IPCC findings, a Greenpeace climate expert told the Guardian: “We’ll be taking this [IPCC] report with us to the courts”.

What else caught my eye?

A former Glencore trader pleaded guilty in the US to bribery charges. According to court documents, the trader and others paid millions of dollars in bribes between 2007 and 2018 in several countries, including to officials at Nigerian National Petroleum Corp., on behalf of Glencore. The Swiss commodity giant said that the “conduct is unacceptable” and has no place in the company. Fixing the company’s imageExternal link is on the priority list of the new CEO Gary Nagle. But it won’t be a quick fix with corruption investigations pending in the US and Switzerland as well as questions about its big profits from coal this quarter, writes the FT.

More

Ex-Glencore trader pleads guilty in oil bribery case

What is commodity trading, anyway? It’s one of the most poorly understood sectors but relevant to almost everything we buy and consume. How did landlocked Switzerland become a hotbed of commodity trading activity? What makes it so controversial and how is Switzerland handling it all? In a 10-minute video explainer, my colleague Céline Stegmüller answers these questions and more.

More

Commodity trading in Switzerland, explained

If M&A activity is any indicator, the Swiss economy is on the upward swing. According to analysis by accounting firm KPMG, M&A activity involving Swiss companies leapt 70% in the first half of the year. Only once in the last 10 years have companies concluded more deals. Nestlé’s purchase of nutrition firm the Bountiful Company and sale of Nestlé Waters North America were two big ticket transactions.

In other M&A news, Lausanne-based Philip Morris International (PMI) increased its bid for UK inhaler company Vectura as part of its “smoke-free” ambitions. According to CNN, the prospect that products to treat lung conditions could end up in the hands of Big TobaccoExternal link isn’t sitting well with health advocates who are calling on the British government to block the deal.

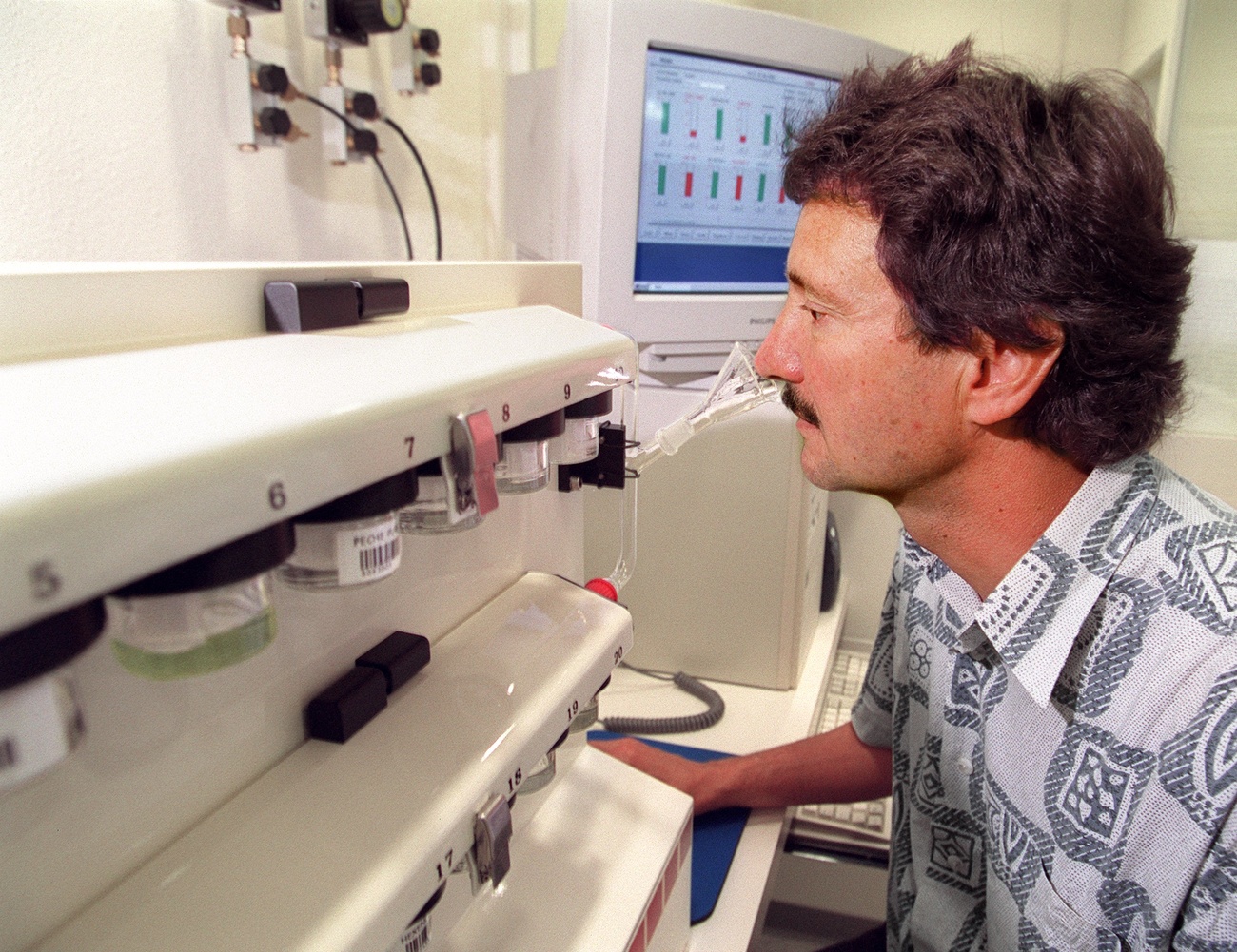

Flowery, fresh or antiseptic? The two largest fragrance and flavour firms vie for data. As the FT writes, Givaudan and Firmenich, both based near Geneva in what the paper refers to as the “Silicon Valley of smell”, are using AI and other technology to gain insight on customers’ rapidly changing scent preferences. The data shows the pandemic has influenced how people want their clothes and homes to smell. Fruit and caramel scents are out, while squeaky clean is in.

Firmenich also made headlines over an agreement with Cameroonian authorities to share in the profits from the sale of extracts from two indigenous plants that grow in forests near Pimbo, a small village in the south-west of the country. As Le Temps writes, the deal is being hailed as a contrast to how multinationals and communities typically share (or don’t) the benefits from natural resourcesExternal link.

Feedback or story tips? Send me a message: jessica.davis@swissinfo.ch. Follow me on Twitter: @JPluessExternal link

Thanks for reading.

Jessica

More

Has a new price premium on cocoa really helped struggling African farmers?

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.