How Santander’s ditching of Andrea Orcel stunned finance industry

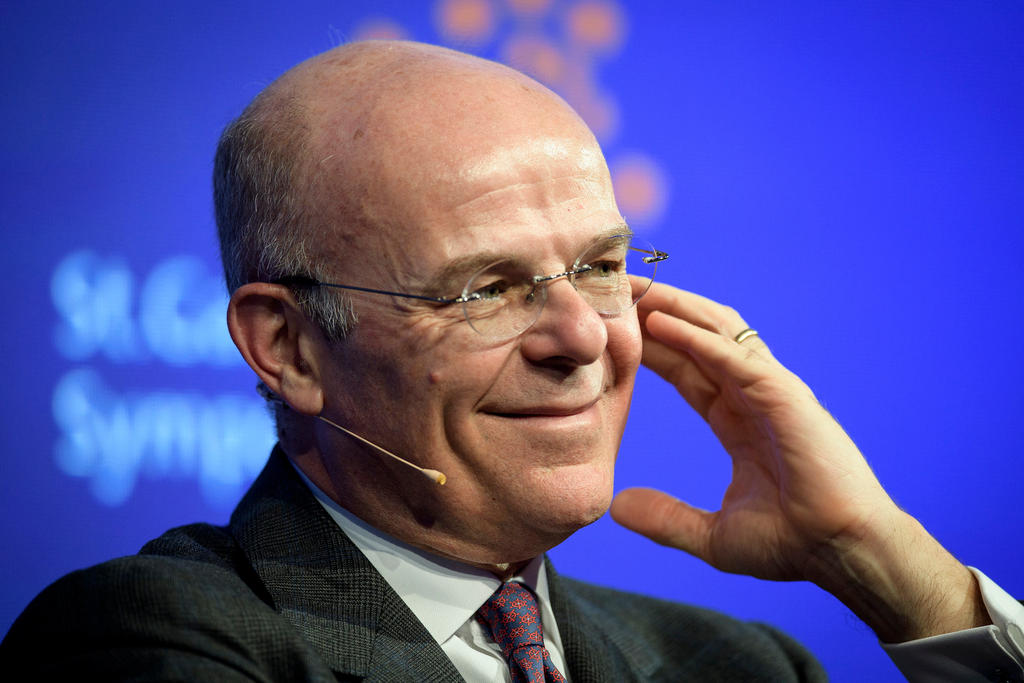

Cancel the welcome drinks and pulp the business cards: Andrea Orcel, the high-profile dealmaker from UBS, will not be joining Santander as chief executive after all.

The announcement that Mr Orcel’s ascension to the top of Spain’s largest lender has been terminated following a row over a €50m compensation package has stunned the banking industry. Indeed, its capacity to shock was second only to the fact that Mr Orcel was appointed by Santander in the first place.

Mr Orcel had expected to receive tens of millions of euros in Santander shares upon joining the bank to recompense him for €50m of deferred stock he earned during his seven-year stint at UBS. Under the terms of Mr Orcel’s contract, the Swiss bank was entitled to withhold his UBS shares because he was joining a rival.

However, in a statement on Tuesday night — released moments before the parliamentary vote on Brexit in the UK — Santander said it had “become clear” that the cost of reimbursing the Italian-born banker would be “significantly above the board’s original expectations”.

Mr Orcel’s attempted transition from the top echelons of investment banking to the world of retail lending was a troubled affair from the start, according to several people who were briefed on the tortured negotiations that culminated in Tuesday’s announcement.

Ana Botín, Santander’s executive chairman, offered Mr Orcel the job in the summer, and was surprised he accepted so quickly: some of his UBS colleagues had considered him a candidate for the top role at the Swiss bank upon the eventual departure of incumbent Sergio Ermotti.

The timing of Mr Orcel’s acceptance was problematic for UBS because he was scheduled to give a shareholder presentation on the group’s investment banking strategy at the end of October, the people said. He quickly handed in his notice and his move to Santander was announced on September 25, although UBS insisted that he take six months of gardening leave.

The hurried announcement did not leave Mr Orcel and Santander with much time to hammer out the details of his appointment, although one person briefed on the negotiations said he did receive a formal offer letter from the Spanish bank that was signed by Ms Botín. He also received assurances that he would be made good on the shares he was forfeiting by leaving UBS, the person added.

Strong relationship

Ms Botín was confident she could find a neat solution to the problem of Mr Orcel’s deferred UBS stock, which accounted for between 50 per cent and 60 per cent of his remuneration thanks to post-crisis rules that require bankers to be paid in locked-up shares that can be clawed back.

Under the terms of Mr Orcel’s contract, UBS had every right to cancel the share awards because he was a “bad leaver” owing to the fact that he was quitting to join a competitor.

However, Ms Botin thought she could convince the Swiss bank that Santander — primarily a consumer retail bank — was not really a rival to UBS’s wealth management and investment banking operations.

Ms Botín had hoped her negotiating position would be strengthened by the fact that Santander was an important client of UBS’s investment bank, the people said.

The connection between the two banks was forged in no-small part by Mr Orcel’s longstanding status as the Spanish group’s most trusted adviser, a bond that was initiated by Ms Botin’s father, Emilio Botín, the architect of modern Santander.

She had hoped that UBS would conclude that its lucrative relationship with Santander was worth protecting, and that it would agree to a deal where it clawed back only some of Mr Orcel’s stock. Then, if Mr Orcel were willing to forfeit part of the money owed to him, Santander could make up the difference.

Mr Orcel used his gardening leave from UBS to take a holiday to the US and South America, while Ms Botín lobbied Axel Weber, the Swiss bank’s chairman, on the merits of her compromise plan.

But Mr Weber was unmoved. One person briefed on the negotiations said he was worried about the optics of UBS handing tens of millions of euros to a departing employee when it did not have to. “It was a matter of principle, not a commercial matter,” the person said.

Sense of betrayal

After it became clear that UBS was unprepared to hand over a cent more than it was required to, Ms Botín sounded out the Santander board about recompensing Mr Orcel with a large award of deferred stock in the Spanish bank.

She had hoped that the bank could sell this to shareholders and customers by arguing that it would mean Mr Orcel’s own wealth was strongly tied his ability to restore the bank’s share price, which has fallen 28 per cent over the past year.

But according to one person briefed on the discussions, Santander’s directors balked at the idea, in part because they feared the political fallout in Spain.

Ms Botín telephoned Mr Orcel last week to tell him his move to Santander was off unless he was willing to sacrifice the majority of the €50m, but the pair were miles apart on how much he should forfeit, according to people briefed on the discussion.

Mr Orcel chose not to take the job, a decision that means he will be able to exercise the UBS stock when it vests.

On Tuesday night Santander was careful to balance the announcement that Mr Orcel would not be joining the bank with fulsome praise from Ms Botín for the man she handpicked as chief executive just months ago.

“We have had to balance the respect we have for . . . the millions of people, customers and shareholders we serve, with the very significant cost of hiring one individual, even one as talented as Andrea,” she said.

But the kind words belied a sense of betrayal felt by Mr Orcel. “He is devastated, not only because of all that has happened, but also because his career is in a shambles,” said one person who recently spoke to Mr Orcel.

Copyright The Financial Times Limited 2019

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.