AI in banking: the reality behind the hype

Deutsche Bank chief executive John Cryan once mooted replacing as many as half his 98,000 staff with robots. His dramatic ousting last weekend means he will not be held to that promise.

But investors need not look far for other bankers talking up the potential of artificial intelligence to revolutionise an industry that has struggled with profitability in the decade since the financial crisis.

Former Citigroup chief Vikram Pandit — reborn as a fintech evangelist — predicted 30 per cent of banking jobs could be wiped out by AI in five years. Mizuho Financial Group in Japan says it will use AI to replace 19,000 people by 2027 — about a third of its workforce.

More

Financial Times

External linkAlmost every big name consultancy has published research on how AI will transform banking. KPMG went one step further with its vision of an ‘invisible bank’ where “enlightened virtual assistants” replace people at all points of customer interaction.

Santander introduced red robots to show guests around their Spanish visitor centre in 2010. UBS has Amazon’s digital assistant Alexa on customer service duty, JPMorgan is using robots (the invisible kind) to execute trades and Morgan Stanley has an AI fraud detection team. Just this week, HSBC said it would follow suit by using AI to detect money laundering, fraud and terrorist funding.

“Long term I think this [harnessing AI and technology] will determine the split between winners and losers,” says Jeroen van Oerle, an investor who runs one of Europe’s first fintech focused funds for Robeco based in the Netherlands.

How the banks want to use AI

What does this mean?

Banks are using chatbots and voice bots to interact with customers and solve problems before any human staff get involved.

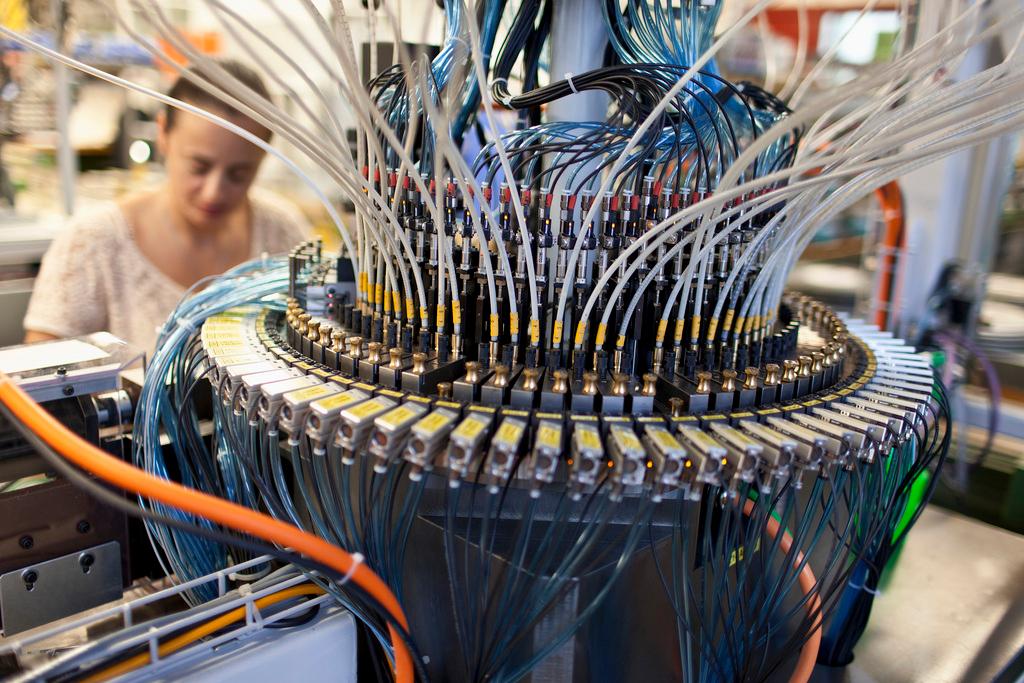

The technology behind it

Natural language processing and generation will make it increasingly difficult for customers to tell whether they are talking to a human or an AI interface. Voice recognition and facial recognition could be used instead of passwords to ensure security.

“In order to keep relevant for the future, you need efficient back office operations . . . on top of that, you need to be able to tailor make products . . . If you cannot provide those kind of services in the future, a competitor will and you will lose.”

That is the hype. The reality is much more complicated. A Financial Times survey of 30 leading banks’ use of AI revealed an industry excited about the prospects of a technology that can help cut costs and boost returns. One bank even predicted that 50-70 per cent of jobs could be replaced.

Yet not only is there little consensus on how AI should be used in banking, many of the current efforts to apply machine learning are modest. Rather than racing towards an AI-enabled future, the industry is feeling its way forward.

What does this mean?

Banks want to offer personalised communications and decisions based on detailed profiles of each customer. They could also use customer profiling and algorithmic sorting to assess risks and precision-target offers.

The technology behind it

AI could use the vast mass of unstructured data on each person to profile customers. Machine learning — computers which can learn from data — could then be used to analyse behaviour patterns. Algorithms could also automate increasing numbers of decisions. Language analysis will also be applied to word choice and syntax to predict decisions. This technology is already being used by some fund managers to assess the word choices of chief executives and work out what that means for future company performance.

“There are too many people making these statements [about big cost and job impacts],” says Foteini Agrafioti, head of Royal Bank of Canada’s AI research arm Borealis.

“The problems we have solved are very narrow,” she adds. “The misconception is that humans and machines can perform at the same level. There’s still a long way to go and many challenges we need to solve before a machine can operate [at a level] even near the human mind.”

Professor Patrick Henry Winston, who headed MIT’s AI lab between 1972 and 1997 and is now a Ford professor at the institute, shares Ms Agrafioti’s concerns about its limitations.

What does this mean?

The banks want ‘low-value processes’ to be handled by AI. This would mean documents being scanned and parsed by computers. Some decision-making could be made by AIs operating with complete knowledge of the regulations and laws in each territory.

The technology behind it

Image recognition and machine learning could be combined to scan masses of documents, and take actions based on the laws and regulations which apply. Algorithms could then be used to decide which cases should be passed to a human decision maker.

“So much of what you need to replace thinking people [with] is not within the reach of today’s so-called AI systems, which are really more perceptual than cognitive,” he says. “When will the cognitive happen? Eventually, but my crystal ball is cloudy on the timing. Few AI people today actually work on the cognitive side.”

As a group, banks all agree that AI is important, but their strategies for using it vary wildly. One European bank that took part in the survey told the FT it had 500-800 people working on AI; Nordea, of Sweden, generally believed to be one of the world’s most technologically advanced banks, says it has just 25. AI budgets vary from below $3m to $15m among the few of the 30 big banks approached by the FT who were willing to disclose the data. One bank says it is ramping up spending from less than $3m a year to $50m-plus.

Overall, while banks are experimenting with AI across their businesses, they are not as bullish as public proclamations would suggest. Of the seven big banks willing to estimate the long-term cost savings of AI, six said it would cut costs by less than 20 per cent, others were more optimistic.

What does this mean?

AI could spot the anomalies or patterns in transactions which might indicate fraud and money-laundering. Face and voice recognition could also flag up fraudsters who are already in the system. Data could be sifted to find trading patterns that indicate risks or investment opportunities.

The technology behind it

Machine learning enables AI to parse the masses of unstructured data to separate the signal from the noise in markets, and it can self-correct. Complex image recognition can be used to identify people and objects.

“There is so much [unrealistic] AI hype in the banking industry and the banking execs are understandably confused,” says Zor Gorelov, chief executive and co-founder of Kasisto, a company that sells an AI platform KAI to banks including Singapore’s DBS, Standard Chartered and 10 others.

“We’re trying to be very realistic and set banks’ expectations around the capabilities of the system. One of the things we do right away is we say, ‘our work system must have contextual connectivity to a person’ . . . because nobody can hand over, and probably for the foreseeable future they will not be able to hand over, 100 per cent of their process to AI.”

More

Can fintech save Swiss private banking?

Beware the hype

Unrealistic expectations are not the only hurdle banks face as they delve deeper into the AI world that promised so much. Several experts say there is a danger that too much investment flows into “sexy” areas such as chatbots at the expense of investment in behind-the-scenes processes where banks could make more significant gains.

So, against all this noise, where are banks focusing their AI attentions? The answer depends in part on what banks consider AI to be. Those that participated in the FT’s research gave definitions as narrow as only programs that perform more basic functions that involve logical reason, learning and self correction without being explicitly programmed (RBC), to a vision of AI that includes all automation (Nomura). One of the definitions was 130 words long. One involved diagrams.

Shameek Kundu, Standard Chartered’s chief data officer, says only about 20 per cent of the 14 AI projects and pilots the bank looked at in 2017 were focused on “pure cost or productivity”.

“Most of them are about improving our risk appetite, reducing the risk but also increasing our ability to take risk,” he adds. Standard Chartered’s AI definition is “a vision and set of technologies and approaches to allow machines to do things that require intelligence when done by humans”.

Risk management is a consistent theme that comes up among the banks. Here the science is on their side, as it is for other rote tasks where human intervention can hinder rather than help. “For repetitive tasks without variability (in middle office, in back end) for clearing/settlement/operational processes that are not particularly in need of smarts, then AI approaches are great,” says Pascal Bouvier, a venture partner at Santander InnoVentures, a fintech venture capital fund of the Spanish bank that invests in early stage fintechs including those focused on AI.

“They are deterministic, and there is really no need for extravagant black box algos, nor is there much of a need for meeting a certain regulatory/legal threshold,” Mr Bouvier adds. “These fall into the category of optimisation, automation, smart automation, robot process automation. Great for banks to cut costs.”

Fears of cuts

As well as risk management applications, JPMorgan’s use of AI to execute trades more efficiently could fall into this category, as could Citi’s development of machine learning to handle pricing requests sent to traders.

Marika Lulay, chief executive of German fintech advisory company GFT Technologies, says there is a “clear difference” between “banks who focus on the understanding that new technology can give them new business models and new ways to generate money [while] other banks have cost reduction as their first goal.”

Banks are sensitive about alarming staff and unions about job cuts and are instead talking about freeing up workers to do more interesting jobs. As the AI debate has evolved, banks have changed their messaging so that the revenue growth potential of AI features at least as prominently as its cost cutting.

“We would like to use AI to bring smarter solutions to our customers, and be more effective in our decision making processes,” says Dutch banking group ING. “As such, rather than ‘AI replacing workforce’ we believe in the power of ‘AI empowered workforce’.”

At Royal Bank of Canada’s Borealis, Ms Agrafioti says her team “prioritise the kind of things that we have evidence we can solve”. This includes “analysing news and determining how world events can affect American markets”.

The outcome will be “potentially revenue creating but also cost saving, these are the kind of tools that our researchers, our advisers, our financial advisers and people that do research will leverage to understand,” she adds.

More

How can artificial intelligence be leveraged for the greater good?

For some, selecting the right areas to use AI is the most difficult issue. “It is easy to fall into the ‘let’s use artificial intelligence for the sake of it’ trap,” says Lindsey Argalas, chief digital and innovation officer at Santander. “Some AI-driven ideas may seem very ‘shiny’ but in reality only create marginal improvements on existing data processing capabilities.”

At ABN Amro, the Dutch bank defends its decision to cast the AI net really wide to include a digital assistant for clients and tools to detect fraud and run risk analysis.

“To discover where the most value lies, we are actively experimenting,” ABN Amro says. “That applies not just for existing services, but also for new opportunities. We are investigating how we can make the work easier for our staff, and how clients can benefit from artificial intelligence.”

As AI projects pull banks in many different directions, evaluating success and leadership is a daunting prospect for outsiders. “It’s very important to separate the marketing story from what the implementation story is, often there’s quite a big difference between the two,” says Robeco’s Mr Van Oerle. “If you look deeper at the core you can make quite a good judgment on whether its marketing is real.”

Mr Van Oerle looks for evidence of improved cost/income ratios and cross selling. “If you don’t see them and the banks say that they are doing all these things in AI you have to ask yourself whether or not it’s not really fundamental,” he says.

He said it would take banks longer to see results on AI programmes for their back office operations, while some were already seeing the impact on the front office side. “We have spoken to several banks that can clearly show that after implementing these technologies they have been able to cross sell much more of their products, and that they are better at communicating with their customers.”

Standard Chartered’s Mr Kundu says it was “too early” for outsiders to see tangible results that would allow them to decide whether his bank’s investment in AI is bearing fruit, especially because most of its AI adventures have been pilots. “Early results have been promising,” he adds. “They will be able to see the impact.”

For outsiders, the superficial signs do not suggest AI is about to take over the industry. It was eight years ago that those robots began showing guests around Santander City, but there is still not a single robot to be found in any of Santander’s 13,697 bank branches.

Copyright The Financial Times Limited 2018

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.