Nestlé bets on Chinese dairy farmers

As the fresh milk market in China booms and local competition increases, Swiss multinational Nestlé has inaugurated a training institute for Chinese dairy farmers in a bid to hold its position as market leader.

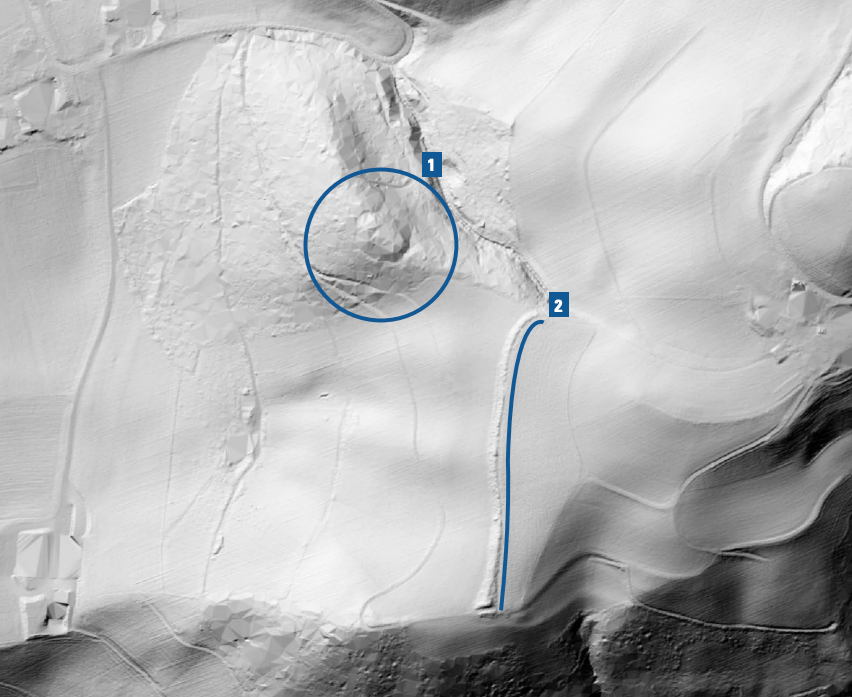

Located in Shuangcheng in the rural state of Xinfu, the new training facility is housed in a large, futuristic, cylindrical building where some two dozen students from various provinces have since October each paid 2,000 Yuan (CHF318) for a three-day course in modern farming methods. The training model used is based on one employed by Swiss agricultural institutes.

Shuangcheng is a large town surrounded by dark earth that is rich in humus and said to be the best soil in the world for agriculture.

The 26 course participants come from Laixi in Shandong province or Ergun in Interior Mongolia where Nestlé has other milk factories. Others have come from Qiqihar, also in Manchuria. Some are dairy farmers who have learnt their trade on the job. Others build stables or milking machines and want to understand the needs of the farmers better.

Classes in the morning are devoted to theory before the students move on to practical exercises in the adjoining model farm in the afternoon. Measuring the humidity of food rations, the correct way to mix hay with other feed elements, managing silos and the importance of precision are all thrashed out in animated discussions.

‘I learnt everything’

One of the first to participate in the Nestlé training programme was Zhu Xiaowei, 45, whom we meet in the village of Aixing, where she manages the local milk collection centre.

“I learnt everything there,” Xiaowei says of the training course.

While the number of small farms in the district has drastically diminished in recent years, Xiaowei senses a change.

Having taken out a loan to purchase cattle and build a modern stable that allows the animals to move around freely, she now raises 55 dairy cows with the help of five other people, mostly family members. Nestlé donated the milking machine, refrigeration apparatus and cistern, and twice a day a truck comes to collect the milk and deliver it directly to the factory.

“The small producers are no longer profitable,” Xiaowei says. “Some older people continue to milk their cows as they are not losing money, but they will have to stop sooner or later because the young people leave to work in the city.”

Xiaowei’s farm produces one ton of milk a day, which is purchased at 4.50 Yuan per litre, the equivalent of CHF0.70. Monthly turnover is about CHF21,000.

Boom and bust

Each year, the Chinese milk market grows by about the equivalent of the entire Swiss market. It’s been a godsend for companies like Nestlé, which quickly made it known it was interested in entering the market in the 1980s when political reform opened China to the world.

At the time, Chinese authorities stipulated that Nestlé must locate in Shuangchen, which was then underdeveloped. The company built its first factory and local farmers began to raise dairy cows, acquiring a few head of cattle and generally managing between five and 20 animals in a small stable in the courtyard of their homes.

In a region that is suited to growing corn, the work was a natural complement to their livelihoods. Here, where there is an absence of grazing pastures and temperatures can drop to -30°C during the long winters, corn is an ideal foodstuff for cattle which never see the light of day.

But in 2008 a tainted milk scandal involving infant formula contaminated with melamine rocked consumer confidence and threatened the development of the milk market in China. Although Nestlé was not one of the companies on the blacklist during the melamine scandal, it was nevertheless affected, and the sector is still recovering.

Mass urbanisation

Health authorities have dramatically reinforced controls since the scandal. In the belief that it will be easier to impose regulations on a larger number of units, authorities are also encouraging more large-scale farming.

But as in Switzerland, the number of small dairy farms is declining, says Hans Jöhr, Nestlé’s director of agriculture.

It’s a change that has been written into the most recent government urbanisation plan, which estimates that by 2020 some 100 million Chinese will move from the country to the cities. If such estimates are borne out, it would be the largest migration from country to city in the history of humanity.

In this context, the number of dairy farmers in the Shuangcheng district has fallen from 32,000 in the early 1990s to just 6,500 today. In the village of Anqiang, home to 600 families, only 20 still produce milk, compared with around 100 six years ago, says Zhang Xiianglong, who manages a farm of 97 dairy cows together with two other farmers.

“There is no curriculum for the peasant agricultural base,” says Nestlé’s Jöhr, “so in the current environment, it is important to offer professional training to those who choose to continue and develop their business, which does have a future.”

Big dreams

Just how big will Chinese milk farms become? While some might dream of massive farms exploiting thousands of animals, not everyone agrees.

Certain directors in the all-powerful National Development and Reform CommissionExternal link in particular, an organisation that succeeded the State Planning Commission, seem to prefer the family or associate model of farming, says Robert Erhard, general manager of the Nestlé dairy farming institute.

In addition, the capacity for managing large-scale farms does not yet exist and so one must start with what is possible, adds Jürg Zaugg, Nestlé China general manager of dairy farming.

That said, the development of the milk market is a priority for the Chinese government. Faced with the emergence of local competitors who benefit from political encouragement, says Jöhr, a foreign company like Nestlé has no choice but to find new ways to keep one step ahead.

Nestlé sales in the China region – which comprises continental China, Hong Kong, Macao and Taiwan – grew 29.3% to CHF6.618 billion ($6.91 billion) in 2013. 90% of products sold are manufactured in China. At 7.2% of total sales, the China region is Nestlé’s second-biggest market behind the United States (25.3% of sales). As of June 2014, the company employed 53,000 people in the region, in 33 factories and four research and development centres. “We are growing faster than our competitors in all segments,” former regional director for Nestlé Roland Decorvet told Bilan magazine in 2013. However, the multinational keeps information on its market development secret.

Fresh milk consumption in the China region has grown by 5% a year since 2011. While Nestlé still has just three Nespresso stores in the region – in Beijing, Shanghai and Hong Kong – the potential of the coffee market is huge. Just 20 years ago, the drink was practically unknown. Today, 50 million of 1.3 billion Chinese are coffee drinkers. It is also worth noting the growing importance of joint ventures to the company’s turnover in the China region. Nestlé owns 60% of confectionary company Hsu Fu Chi and of boiled rice and peanut milk manufacturer Yinlu, and 80% of spicy sauce manufacturer Totole and Haoji.

(Adapted from French by Sophie Douez)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.