Five things a whistleblower has to say about tax havens

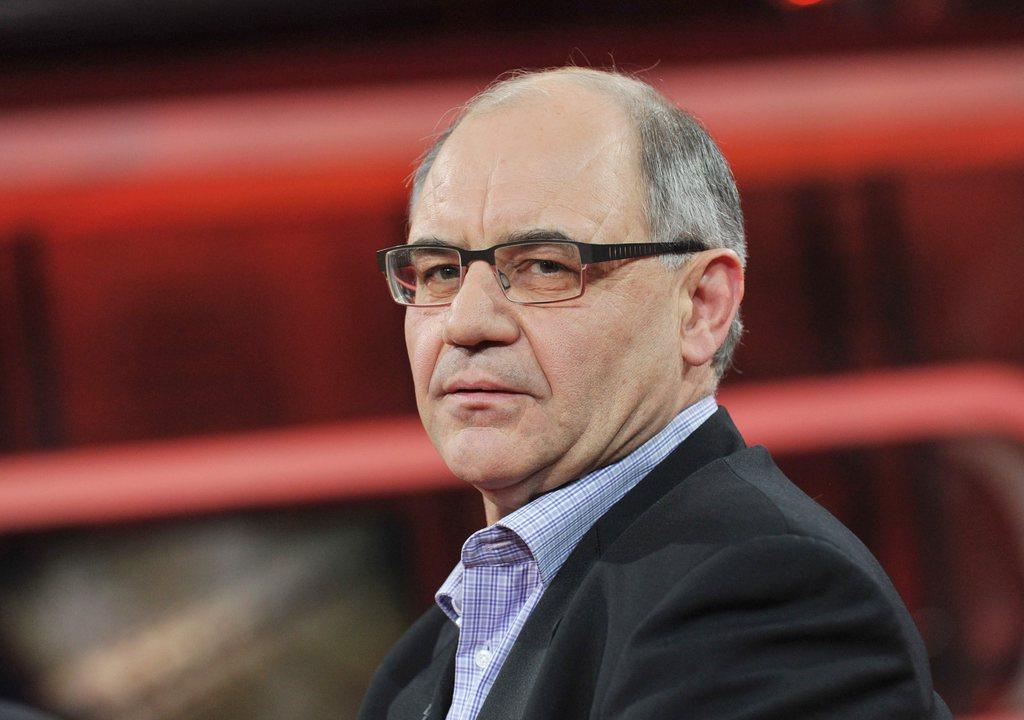

Following the release on Sunday of the Panama Papers, former whistleblower Rudolf Elmer spoke with journalist Roger Schawinski on Swiss public television, SRF, about secrecy, responsibility and greed.

The Panama Papers scandal will not stop tax havens

Eleven million documents revealing the offshore banking practices of Mossak Fonseca show that Swiss banks (Credit Suisse Channel Islands Ltd., HSBC Private Bank Suisse, UBS AG) and Swiss lawyers are major players in offshore banking.

Elmer: “The tax havens are certainly not dying out. The practices will continue. It will only get more lucrative.” Elmer sees the concept of a worldwide transparency standard as unlikely, “as long as the G7 countries or the United Nations are not behind it”.

Not all offshore companies are for shady business

Offshore companies are not only used for money laundering, transfer of terrorist funds, protection of identity, circumvention of sanctions, and tax evasion.

“I can understand that someone in Russia would bring their money to Switzerland because in Russia it might be confiscated. They want to have the money somewhere that’s politically stable. And those are legitimate grounds.”

Whistleblowers have many reasons for leaking information

Rudolf Elmer stole a hard disk containing information about his company’s offshore business. After evaluating the data, he realized that it contained information about highly illegal practices. He later published a book and was featured in a movie.

Elmer: “Motive plays a role if you demand money. When I realized what kind of criminal clients I had – that’s when the pacifier dropped out of my mouth. I lost my trust in the entire system.”

Corruption can go unnoticed within a company

Part of the problem is that everyone has only one piece of the puzzle. According to Elmer, he wasn’t fully aware of what was going on in his company. He was in charge of the bank side, and compliance, but not securities. His company’s guidelines “looked super!” Reality was something else.

“On the company side I thought, the management in Zurich and in New York make the decisions. I can trust them. But later, when I sat in the hospital and looked at the data, I thought – no!”

Personal ethics are as important as professional accountability

There’s corruption everywhere, says Elmer. “You’ll find corrupt people in Germany and Switzerland, too.”

“At some point you have a social responsibility,” says Elmer. “As a man, you have to take a stand and say: This is not good, and the public needs to know. At some point the interests of the public outweigh the interests of an individual company.”

Rudolf Elmer was a senior executive at Julius Baer bank’s Cayman Islands branch until he was fired in 2002. In 2007, he passed on information to the WikiLeaks website that he claimed showed his former employer set up trust funds and other banking constructs to help clients evade taxes through offshore accounts.

He was arrested and ordered to pay a fine of CHF45,000 ($47,000) along with court costs of CHF25,000 by a Zurich court in 2015 for violating Swiss banking secrecy laws.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.