One in 10 Swiss private banks disappeared in 2015

The much vaunted Swiss private banking sector lost 10% of its institutions last year as it continued to groan under the weight of rising cost, the high franc and increasing regulations.

A survey by KPMG and the University of St Gallen maintains its prediction of last year that around a third of Swiss-based private banks will disappear as the industry realigns itself to a harsh new climate. The global crackdown on tax evasion and money laundering has also played a large hand in the industry’s declining fortunes.

Banks have also struggled to cope with a sharp fall in income from risk adverse clients and a low interest rate environment. They have been forced to find new ways of making money from clients who no longer pay simply to hide behind the now-defunct shield of Swiss banking secrecy laws.

More

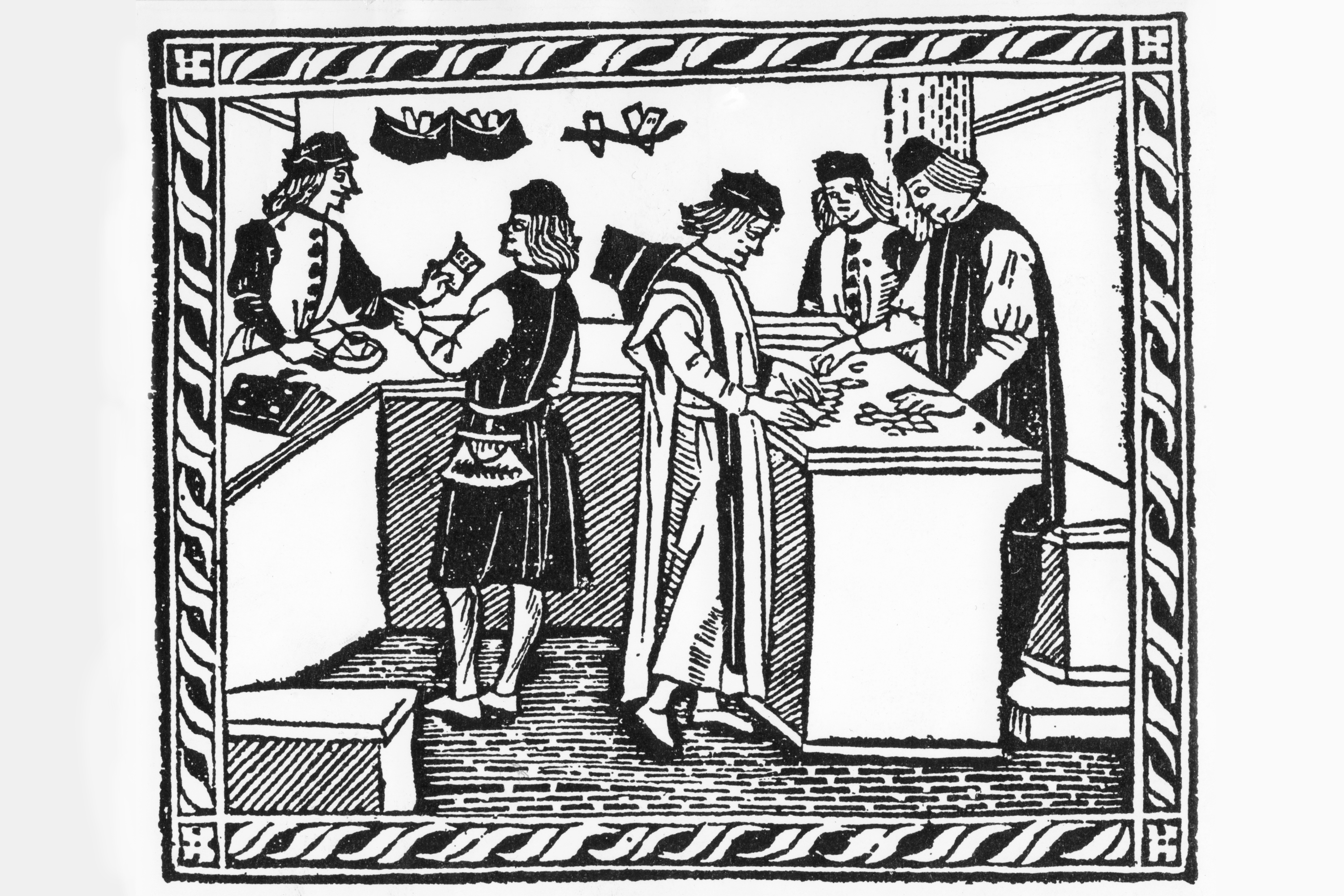

History bites back at Swiss private banking

Established names like Bank La Roche (founded 1787) and Hottinger (which traces its roots back to 1786) vanished last year. But the procession was led mainly by foreign-owned private banking branches, such as Coutts.

Several other players have joined the list this year, led by the acquisition of BSI Bank by EFG.

Two tier performance

The fortunes of private banks have been sharply divided since the 2008 financial crash, according to the study. The largest players, plus small niche boutiques, have ridden the storm better than medium to small sized players.

The biggest of the banks surveyed have had enough financial clout to beef up compliance teams and upgrade IT systems, combined with a physical global presence that allows them to tap into the growing markets of Asia and Latin America. Switzerland’s two largest, UBS and Credit Suisse, were not included in the survey.

“The gap between the strongest and the weakest banks continues to widen,” said the KPMG/University of St Gallen survey of 87 Swiss banks. “Rather than the strong players pulling ahead, however, it is the weak performers who are in continuing decline.”

Some 55% of the banks surveyed were classified as either outright weak performers or as those that have functioned relatively well since 2010, but saw performance slide last year. Only 18% stood in the category of strong performers.

Revenues fell at 68% of banks last year, reducing margins. The report says that not enough banks are taking appropriate measures to halt their decline in performance.

Shrinking assets

The findings were broadly backed up by a separate private banking study released by consultancy firm Roland Berger this week. This study looked at 55 Swiss and Liechtenstein banks including UBS and Credit Suisse with combined assets under management of CHF4.9 trillion ($5.7 trillion).

However, that impressive figure hides a myriad of problems for many of these banks, the report states. Last year saw a marked drop in net new money to CHF88 billion last year, down from CHF109 billion in 2014. This indicates that wealthy people are less inclined to deposit their assets at private banks.

Three quarters of the surveyed banks have seen a fall in either revenues, which are fees derived from managing assets, or in gross margins, which are also called profit – or both.

Eighty Swiss private banks have disappeared in the last decade according to the report.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.