Swiss banks follow the money to Panama

Sunshine, a lower cost of living and the inevitable low rate of taxation are what brought Michel*, a retired Geneva private banker, to Panama last year. Swiss banks have also been casting their net in the Latin American state.

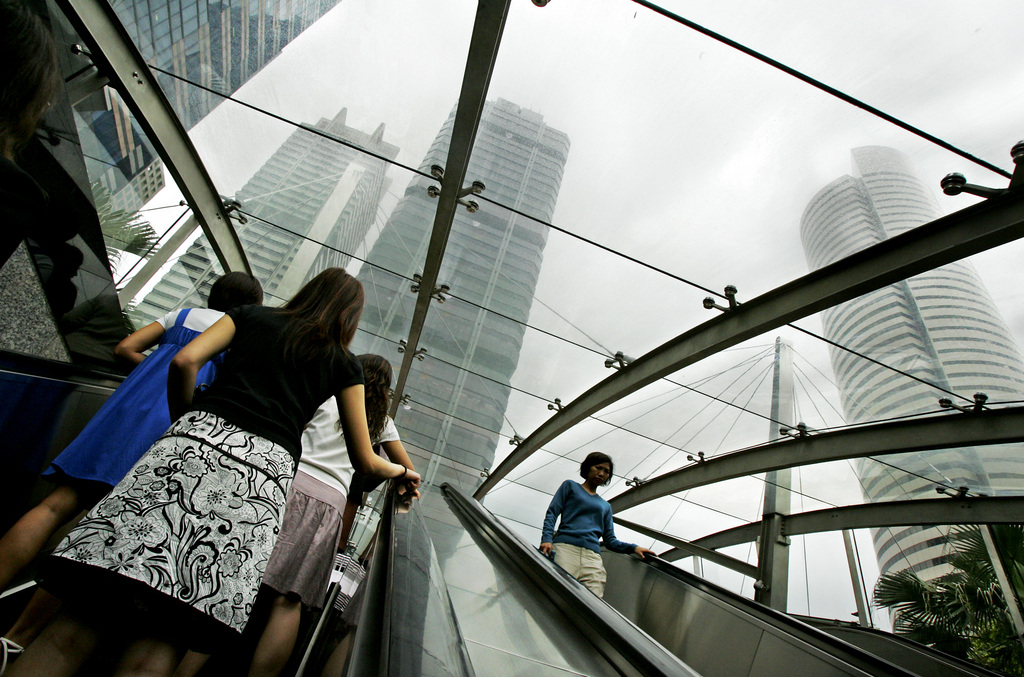

“I had enough with having to pay so much tax in Europe”, the dapper-dressed man explained on a recent sunny, hot day in the skyscraper-filled centre of Panama.

While Panama is renowned for its light tax burden, including tax exemption on foreign-earned income for foreign residents, it was the growing pressure from international fiscal authorities on banks and clients back in Europe, and mounting competition from other financial centres, that has had many Swiss financial institutions looking for sunnier horizons elsewhere.

In February, Lugano-based BSI was granted a banking license to operate here, while UBS, Credit Suisse and Lombard Odier, amongst others, have advisory offices, which act as liaisons between the banks and their clients. In November last year, Julius Baer began operating a wealth management business from Panama, which it had acquired from Merrill Lynch.

PKB Privatbank was the first Swiss private bank to open in Panama in 2012. “We wanted to diversify our client channels and expand in Latin America,” Francesco Catanzaro, the Panama bank’s manager told swissinfo.ch.

A spokesman for Lombard Odier explained by email: “We set up an office in Panama one year ago to be closer to the local client base,” adding that the country “is, and has historically been, a regional hub for financial services in the region”.

“There is plenty of economic growth in the region and it is a promising market” for bankers and asset managers, according to Giuseppe A Marca, Swiss owner of GaMFOs, a multi-client family office in Panama.

But competition for this lucrative market is tight amongst the increasing number of asset managers interested in entering the region, A Marca explained. “You need to have been in the market before, otherwise it is very difficult to enter”.

Catanzaro said United States banks, which hold “the main chunk of the business”, would send bankers into the zone to create accounts for their clients in the US, maintaining a minimal physical presence. This, he said, offered others business opportunities. In the end, he added, “The private banking market is very underdeveloped here”.

The PKB Privatbank manager said that Panama remains small, in terms of the value of assets under management, at an estimated USD 80 billion compared to approximately USD 2 trillion in Switzerland.

But that figure is expected to grow exponentially.

According to Knight Frank’s 2013 World Wealth Report, Latin America experienced a 146% growth in the number of ultra high net worth individuals (UHNWI) in the previous 10 years, and is expected to see that number grow an additional 46% in the next decade. A 2013 report by the Boston Consulting Group said Latin American private wealth would increase to $5.9 trillion by 2017 (global private wealth was $135.5 trillion in 2012, of which $8.5 was offshore).

The Spanish daily El Pais, estimated that in 2013, Panama alone was home to 115 such individuals, with an accumulated net worth of USD 16 billion.

At the end of 2013, the United Nations projected that Panama would have the highest growth rate in Latin America, at 7.5 percent. The canal, which is currently being enlarged to accommodate larger vessels, is expected to increase Panama’s more than $1 billion annual revenue.

Out of regulators’ reach

“Things have become very difficult in Switzerland, with all the publicised cases involving some of the banks, and the new rules that are being put into place, where there will no longer be banking secrecy,” explained Roberto Aleman. Aleman is a partner at the legal firm Icaza, Gonzalez-Ruiz & Aleman, which has offices in many offshore centres – including Panama and Geneva – and offers financial services for corporate, public and individual clients.

Aleman told swissinfo.ch that Swiss bankers might have been motivated to come to Panama because it’s “where they believe they can better protect the confidentiality of their clients”.

But Catanzaro warns that changes in banking regulations requiring disclosure of client information are also taking place in Panama, “The pace is somewhat slower, but tendencies to comply with OECD standards are here”.

Aleman stated that the United States, through its own Foreign Account Tax Compliance Act (Fatca), will not be overly concerned with other people associated with the US, having Swiss bank accounts in Panama. “I don’t think the authorities are that far-reaching”.

The OECD standard calls on jurisdictions to obtain information from their financial institutions and exchange that information automatically with other jurisdictions on an annual basis. It sets out the financial account information to be exchanged, the financial institutions that need to report, the different types of accounts and taxpayers covered, as well as common due diligence procedures to be followed by financial institutions.

The new standard, according to OECD Secretary-General Angel Gurría will help put “governments back on a more even footing as they seek to protect the integrity of their tax systems and fight tax evasion.” It also incorporates efforts to reinforce global anti-money laundering standards.

And it recognises the catalytic role that implementation of the US Foreign Account Tax Compliance Act (FATCA) has played in the G20 move towards automatic exchange of information in a multilateral context.

The OECD is expected to deliver a detailed commentary on the new standard, as well as technical solutions to implement the actual information exchanges, during a meeting of G20 finance ministers in September 2014.

Switzerland supports the OECD Standard and will implement FATCA from the summer of 2014.

(source: OECD)

The lawyer nonetheless said that regulations for opening bank accounts in Panama have become stricter. Know your client (KYC) rules now apply, requiring that one of the beneficial account owners be present when the account is opened, and be interviewed by the bank.

Icaza, Gonzalez-Ruiz & Aleman, one of Panama’s oldest legal firms, has set up thousands of corporations or companies for foreign citizens, including Swiss, who benefit from very low taxation, and confidentiality.

Following a new regime introduced here last year, bearer shares in Panamanian corporations must be immobilised under the safekeeping of a custodian. Bearer shares are freely transferable securities, which do not require the inscription of the owner’s name.

Aleman said that while “bearer shares were more or less going into extinction”, they still were useful “for estate planning and for businesses that are declared”.

A site sourcing information about Panamanian companies from the national mercantile registry created by a hacker (see link), presents dozens of corporations directed by Swiss private bankers and lawyers.

In April last year, the Offshore Leaks project, carried out by dozens of journalists around the world, revealed names of people linked to offshore accounts. The Swiss newspapers, Matin Dimanche and SonntagsZeitung, stated that between 200 and 300 Swiss lawyers were actively involved in assisting clients evade taxes, by setting up offshore accounts in tax-free companies, including in Panama.

Aleman stated that when a Swiss banker or lawyer’s name is registered in numerous companies, “I would say that they are catering to or providing a service for their clients.” He added though that “some of them may have companies for themselves.”

As “an important percentage” of Aleman’s business consisted of company creation for Swiss clients, the disappearance of banking secrecy in Switzerland has strongly impacted the firm. “There are a lot of dissolutions of companies registered in the Panama public registry, and people are just abandoning the companies and not having bank accounts in the name of the companies”.

When asked what legal alternatives existed for clients seeking confidentiality, Aleman replied, “It is more and more difficult. We are moving more towards a situation where confidentiality is no longer going to be the name of the game”.

“If people want to have money outside of their country, they are going to have to declare that money, and they may use a company to use an account. But the money will be declared in their country of origin,” the Panamanian said.

“Everything now is due diligence. It’s a whole new ball game,” the partner explained.

*name altered for story

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.