Blockchain property start-up encounters regulatory resistance

A Swiss blockchain start-up that aims to open up the real estate investment market to more people has run into a regulatory hurdle. The case of SwissRealCoin shows that the relationship between the new disruptive technology and the regulators is still delicate despite Switzerland making strides to welcome blockchain to the country.

Rock bottom interest rates have made real estate attractive for investors, particularly in Switzerland. Short of buying a house to live in or rent out, people can invest in property funds that entitle them to a share in real estate portfolios. This CHF2.8 trillion ($2.83 trillion) global market (CHF32.2 billion in Switzerland) is dominated by large institutional players.

SwissRealCoinExternal link aims to make such investments an easier proposition for the person on the street. Their sales pitch is a familiar one in the blockchain scene, but is so far unproven given the novelty of the innovation.

More

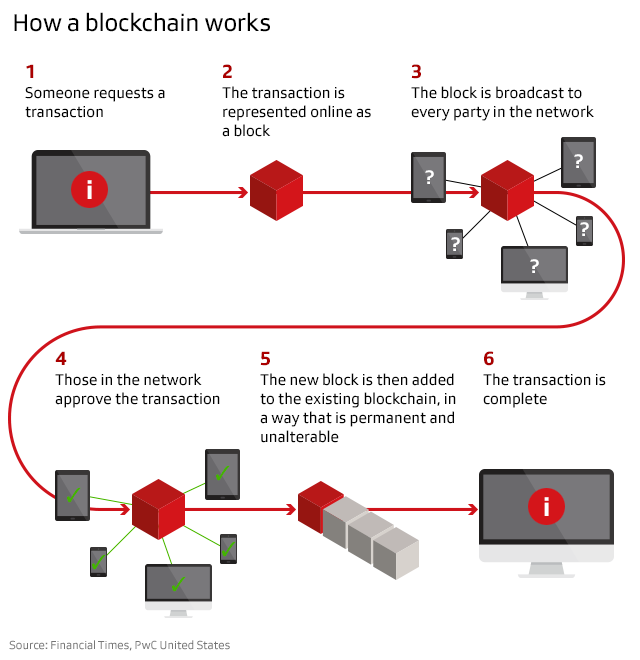

How blockchain could soon affect everyday lives

The start-up had wanted to kill two birds with one stone: provide better access to real estate investments whilst curing the ongoing problem of price volatility in the crypto space.

Here’s how SwissRealCoin sees that working: The company will build up a portfolio of Swiss commercial real estate for its blockchain operated fund. Its token, also called SwissRealCoin, represents a stake in the fund that can be traded on exchanges. Token holders get to vote on which properties the fund purchases or divests and will be fed a stream of real time data on its performance.

Regulatory hiccup

But the promise of increasing transparency and reducing costs by cutting out the middleman has so far failed to fully convince the regulator or the established industry.

The Swiss Financial Market Supervisory Authority (FINMA) has so far refused to issue a “no action” verdict, releasing the platform from regulatory oversight. This has forced a new approach of looking at the possibility of setting up as a fund or as a listed exchange.

“We are surprised and disappointed by the missing guidance from FINMA how to properly structure an innovative security token,” SwissRealCoin CEO Brigitte Lugenbühl said in a blog post entitled “Unclear regulatory framework for security tokens in SwitzerlandExternal link”. “We’re clearly a first-mover and unfortunately the regulatory framework isn’t ready yet to accommodate the new asset class we’re creating.”

FINMA, which was one of the first regulators to issue guidance on cryptotokens in February, declined to comment. Several crypto start-ups have complained the FINMA’s directive is too vague. SwissRealCoin have found out that issuing guidance does not mean the regulator will bend its rules to fit a new business model – or let unregistered securities in through the back door.

Stable coin

Other blockchain start-ups are opting to declare their product as a security such as TokenestateExternal link, which plans to launch itself as an exchange specialising in the trade of real estate cryptotokens (see box below).

Despite the setback that has forced SwissRealCoin to delay its initial coin offering (ICO) crowdfunder, the company is still determined to get its fund up and running in Switzerland in one form or another.

Lugenbühl believes that backing the token with Swiss real estate will give it greater price stability than other cryptocurrencies. The value of bitcoin and other cryptos has risen and fallen stratospherically in the last 12 months, creating a headache for holders who can’t predict how much their tokens will be worth in the coming months.

The danger exists that the value of the SwissRealCoin token could outstrip that of the underlying property assets if it becomes a popular trade on exchanges. To prevent this, the platform would automatically mint and sell new tokens to buy more property, thus diluting the value of the token and increasing the value of the property fund in one stroke.

“In the real world, the Swiss franc has shown stability based on the fundamentals of a stable Swiss government and a solid economy,” Lugenbühl told swissinfo.ch. “Our token is designed to give the same price stability when the price of other cryptocurrencies is volatile.”

Open questions

These so-called proptech innovations promise to disrupt and transform the industry for the better. Experienced Swiss real estate investment expert Cedric Vinclair is confident that the largely experimental blockchain technology could bring advantages, but it also poses unresolved questions, he says.

For one thing, besides saving costs of drawing up legal documents it is unclear to Vinclair how many other expenses can be avoided in the business of buying, developing and managing real estate. Vinclair admits that he is no expert when it comes to blockchain coding and smart contracts, but he also would like to understand how the new technology secures the cryptotoken to the underlying property assets and, ultimately, the investor – particularly as tokens can change hands so easily without the need of third parties to verify the transactions.

Furthermore, Vinclair questions how such platforms will deal with the potential volatility of allowing tokens to be bought and sold so easily. What happens if large numbers of inexperienced investors bail out at the same time in a panic sale?

“We know perfectly well that blockchain is the next technological step in the way of doing business in the real estate sector,” he told swissinfo.ch. “But as with all new technologies, the devil lies in the details of how they operate in real markets.”

Besides SwissRealCoin, Switzerland is also home to other so-called ‘proptech’ enterprises that utilise blockchain in the real estate industry.

Tokenestate, is betting on blockchain becoming a dominant force in the real estate investment sector. It is positioning itself as a global exchange for such cryptotokens, a specialised platform where people can easily trade their property investments.

“Most funds have entry barriers, such as a minimum size of investment that is out of the reach of many people,” founder and CEO Vincent Trouche told swissinfo.ch. “The involvement of brokers, underwriting banks and exchanges typically adds around 5% in transaction costs. Blockchain will make that system more efficient.”

Blockchain also has attractive features for people simply wanting to buy or sell a property or for landlords, according to Elea LabsExternal link that operates out of Zug’s Crypto Valley. Elea is setting up a platform to accumulate data on property prices and rental yields that would allow users to compare notes and benchmark valuations.

The difference between the Elea blockchain and price comparison websites is the extent to which users can interact with each other, Elea says. This could even extend to tenants and landlords bartering rental payments based on the condition of the property and how reliable a tenant has been with previous payments and looking after the property.

Another crucial advantage, according to Elea, is that users of the blockchain own and control their own data independently and don’t have to entrust it to third parties, such as website administrators.

Real estate data platform eLocationsExternal link is going through the process of issuing its own cryptotoken. “It will ensure we are sufficiently invested to grow our platform and leverage blockchain technology – reducing the delays and mistakes that frustrate the real estate market today,” founder & CEO Marc Riebe told a recent blockchain summit in Zug.

eLocations has built up a database of commercial property to lease worldwide. It aims to convert paper-based leasing agreements to blockchain-based smart contracts to speed up the administrative task.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.