Greeks stock up on Swiss watches

Swiss watch exports to Greece are on the rise, despite the country’s economic crisis. Compared with last year, sales are up 26%. One expert thinks this could be down to Greek jewellers investing their cash in a stable product.

Between January and May 2015 CHF40.4 million ($43.3 million) worth of Swiss watches was exported to Greece, up from CHF32 million for the same period last year, the Federation of the Swiss Watch Industry revealed on Tuesday. This growth was the second-largest in the worldExternal link, pipped only by Britain (26.7%).

An end to the Greek watch boom is not in sight, added the federation’s president, Jean-Daniel Pasche.

Nikolaos Aggelidakis, president of the Swiss-Greek Chamber of Commerce, was surprised, telling the Tages-Anzeiger newspaper that Greek trade associations had said fewer watches were being bought by Greeks. He presumed it was Greek jewellers who were investing their money reserves in Swiss watches, considered to be stable in value.

But how good are Swiss watches as an investment? Ian Skellern, a watch brand consultant and blogger, told swissinfo.ch that as a general rule, a new Swiss watch is like a new car, “that is, it drops 30% as soon as it leaves the showroom”.

“There are a few rare, highly sought after, watches that appreciate in value, but they are few and far between and it takes a lot of experience and knowledge to pick the winners,” he said.

Overall export decline

Whereas Swiss watchmakers are benefiting from the Greek financial crisis, other sectors have seen considerable drops in exports.

Total Swiss exports to Greece fell 11% between January and May 2015, continuing the decline since problems began in 2008.

Around three-quarters of Swiss exports are chemical or pharmaceutical products, according to the foreign ministryExternal link. One significant supplier, Basel-based Roche, is now delivering medicines only against prepayment.

Greek businesses complaining

Meanwhile, the uncertainty continues. Global markets have been rattled as a standoff between Greece and its lenders has intensified, with Greece looking like defaulting on a €1.6 billion (CHF1.66 billion) loan on Tuesday and at risk of sliding out of the eurozone.

The Swiss Market IndexExternal link opened on Monday down 3% but the country’s 20 largest companies rallied and ended the day down 1.5%.

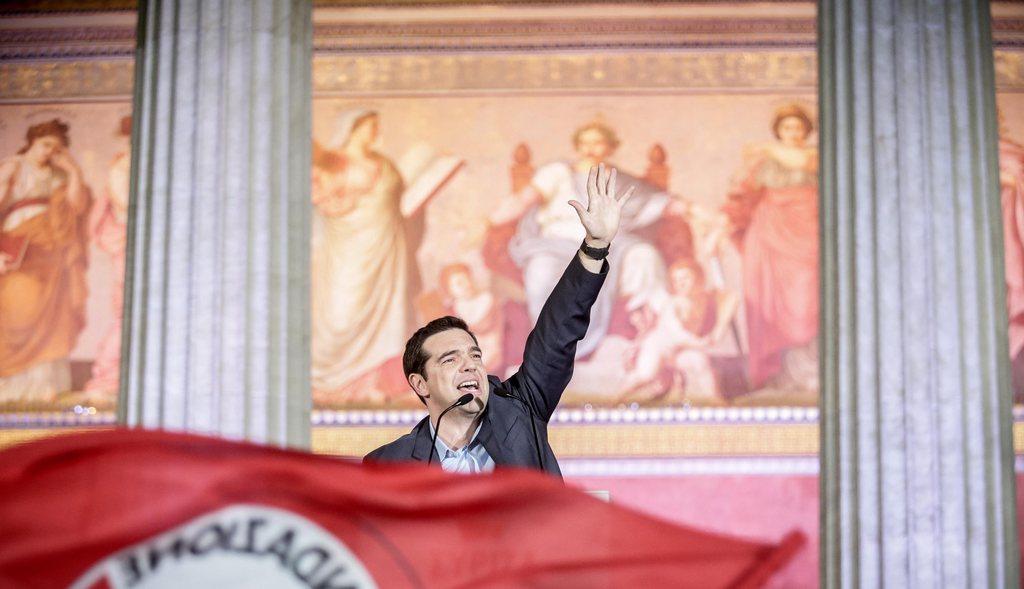

Greek Prime Minister Alexis Tsipras has broken off negotiations with the European Commission, the IMF and the European Central Bank and announced a referendum on the country’s bailout terms on July 5, giving voters just one week to debate the fundamental issues at stake.

On Monday, cash machines in Greece remained closed until midday and then opened for withdrawals of no more than €60 a day.

Businesses complained that they could not pay salaries or suppliers and had to halt imports.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.