Charting the Global Economy: Assad’s Fall Adds to Middle East Instability

(Bloomberg) — The toppling of Bashar al-Assad’s government has added a new source of instability in the Middle East, with Turkey asserting itself as the main player in the shaping of Syria’s future.

Turkey has a strong incentive to help forge a stable and peaceful Syria out of the ruins of the Assad regime, not least because the country hosts at least 3 million refugees from its southern neighbor. Turkish companies would also stand to benefit if and when postwar reconstruction starts.

Meanwhile, the cost of money is getting cheaper in the world’s largest economies. The European Central Bank, Swiss National Bank and Bank of Canada reduced interest rates ahead of an expected cut by the Federal Reserve next week.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

Europe & Middle East

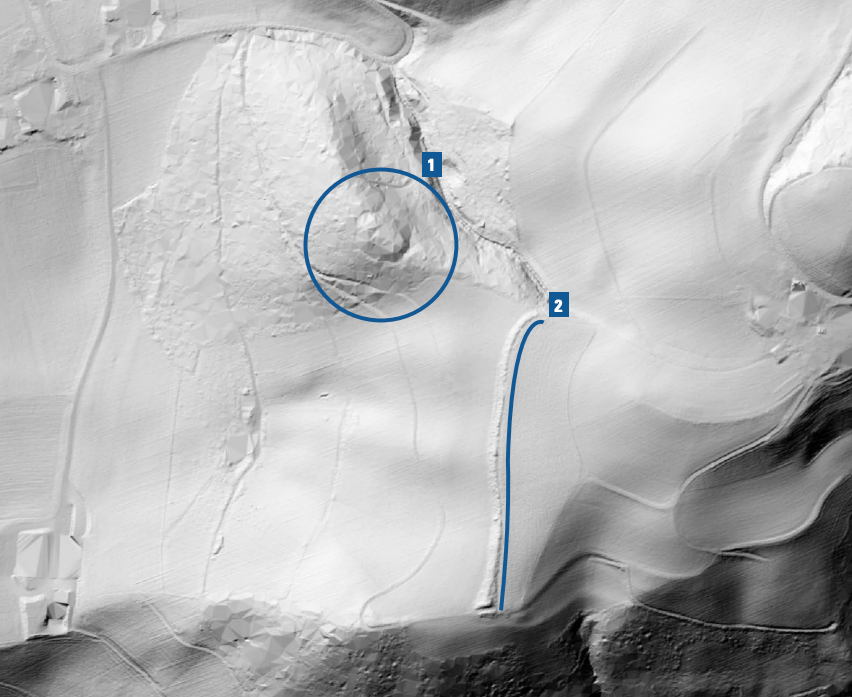

Syrian President Bashar al-Assad’s government fell after a stunning territorial advance by opposition groups. The toppling of the longtime ruler is sending shockwaves through the Middle East and will be a major blow to Russia and Iran, his main foreign backers.

The ECB lowered interest rates for a third consecutive meeting, signaling more reductions next year as inflation nears 2% and the economy struggles. Indicating its shifting stance, the ECB’s statement dropped wording saying policy will remain “sufficiently restrictive” for as long as necessary.

The Swiss National Bank delivered a bigger-than-expected 50 basis-point interest-rate cut, a move that might help stem gains in the franc. The central bank’s biggest reduction in the current cycle amounts to a show of force at Martin Schlegel’s first decision as president, aiming to unsettle traders who have plowed money into the franc in recognition of its traditional role as a haven at times of geopolitical stress.

World

The abrupt and unusual diplomatic mission by Kristalina Georgieva underscored the International Monetary Fund’s sense of urgency about preserving Middle East stability, well before events this week in Syria further showed just how fragile its governments can be. Rulers of economies that have seen precious few gains in living standards since the Arab Spring erupted 15 years ago are looking on with unease as yet another fire burns in a region already blighted by conflict in Gaza and disruption in the Red Sea.

For the year ahead, Bloomberg Economics forecasts global growth at an unremarkable 3.1%, unchanged from 2024. Inflation is set to slow to 3.4% from 6%, with readings in the US and other advanced economies drifting back to the 2% central banks have long targeted.

Outside of the ECB, Bank of Canada and SNB, Australia’s central bank left borrowing costs unchanged and acknowledged it’s gained some confidence inflation is moving lower. Uzbekistan and Peru also kept rates steady. Brazil raised rates a full percentage point and promised more to tame inflation expectations, while Armenia and Denmark cut.

US & Canada

Consumer prices rose at a firm pace in November that was in line with expectations, solidifying expectations for the Federal Reserve to cut interest rates next week. Shelter costs, one of the most persistent sources of inflation in recent years, cooled from the previous month.

The Bank of Canada made its second straight outsize cut in interest rates and signaled policymakers are ready to slow down monetary easing. In a span of five meetings in roughly six months, the Canadian central bank has lowered borrowing costs by 175 basis points, becoming one of the most aggressive rate-cutters among the central banks of major economies.

Charging 25% levies on oil and gas from the US’s top two trading partners would spike gasoline prices in the Midwest, raise electricity costs along both US coasts and hammer profitability for America’s refiners, among other effects, experts say. While tariffs can be disruptive in any market, they threaten to be particularly troublesome for a North American energy industry that has been tightly integrated for decades and already largely favors US interests.

US economic indicators can move global markets by trillions of dollars at a time. The agencies that collect and publish those statistics have been pleading for an extra few million, to maintain the integrity of the financial world’s most important numbers. Now they face an even tougher fight to get it, as Donald Trump heads back to Washington with a plan to slash the federal bureaucracy.

Asia

China’s top leaders signaled bolder economic support next year using their most direct language on stimulus in years, as Beijing braces for a trade war when Donald Trump takes office. The Politburo also pledged “more proactive” fiscal policy at its monthly huddle, raising expectations for Beijing to widen the fiscal deficit from 3% at the annual parliamentary session in March.

South Korea is facing greater downside economic risks as it tries to mitigate the impact on its currency of the turmoil triggered by last week’s martial law declaration, its finance minister said Wednesday.

Emerging Markets

Brazil’s central bank lifted its key interest rate by one percentage point and surprised investors by promising two more hikes of the same size, its strongest move yet to recover investor confidence and tame inflation expectations that have been propelled by public spending and a hot economy.

Mexico’s headline inflation slowed slightly more than expected in November, boosting the odds of a fourth straight interest rate cut at the central bank’s meeting next week.

South African retail sales unexpectedly galloped to their highest level in more than two-years in October and are excepted to continue to advance, boding well for the economy.

–With assistance from Tom Orlik (Economist), Beril Akman, Bastian Benrath-Wright, Maria Eloisa Capurro, Sam Dagher, Katia Dmitrieva, Elizabeth Elkin, Selcan Hacaoglu, Erik Hertzberg, Lucia Kassai, Sam Kim, Yujing Liu, Iain Marlow, Abeer Abu Omar, Zoe Schneeweiss, Omar Tamo, Randy Thanthong-Knight, Robert Tuttle, Monique Vanek, Alex Vasquez and Josh Xiao.

©2024 Bloomberg L.P.