How Switzerland benefits from development aid

Switzerland has great influence in development banks, controversial supranational organisations intended to promote economic development in poor countries. However, Switzerland is also a beneficiary – from World Bank funds which flow via corruption into Swiss bank accounts, according to a new study.

When the World Bank makes funds available, the aim is to stimulate the economy in a specific developing or newly industrialised country. But it’s almost a law of nature that such disbursements coincide with sharp increases in bank deposits by the country’s rich citizens in offshore financial centres.

A study by the World BankExternal link concludes that 7.5% of the development funds it disburses end up in bank accounts in tax havens as a result of corruption in the recipient countries. Switzerland, with its banking centre, is the main destination.

Swiss banks thus benefit indirectly from funds that development banks actually make available for the economic development of poor countries.

Daniel Birchmeier, head of multilateral cooperation at the State Secretariat for Economic Affairs (SECO), does not know the details of the study. He points out, however, that the study used less robust data for the more recent period under review and that these show statistically less significant effects. He says that corruption is a problem in many poorer countries that needs to be curbed both institutionally and with monitoring measures.

Swiss companies benefit

But Switzerland earns much more directly from the money of the development banks like the International Financial Corporation (IFC)External link. Swiss companies benefit from orders financed by development banks and are particularly well-represented in the health, finance, water infrastructure, energy and agricultural sectors.

The public tenders of the development banks are in principle open to all applicants. However, it remains striking that Swiss companies repeatedly win these lucrative contracts. Swiss companies have obviously developed a certain professionalism in this area. It remains to be seen whether the tenders are already tailored to the needs of the companies, or whether other countries lack experience with the sometimes complex tendering procedure.

Ultimately, Swiss companies not only receive a contract in the recipient country, but ideally also have one foot in a new, emerging market.

Swiss influence

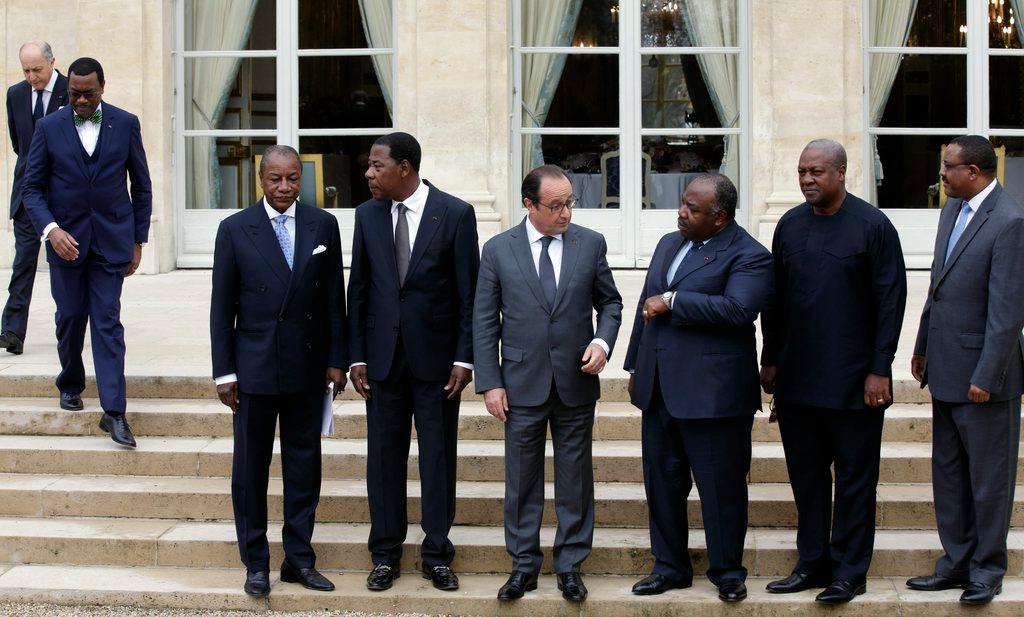

Switzerland is a small country, but it has quite a loud voice when it comes to development banks. The US and China might be the most powerful member states, but Switzerland chairs important commissions, has executive directors in several banks, and has a relatively high proportion of voting rights owing to its economic strength and large capital contributions.

“Switzerland has above-average influence for its size,” Birchmeier says. “It’s a top-ten donor and has also informally established a good position for itself by actively contributing suggestions. Switzerland is one of the opinion leaders.”

“There’s a divide between Western states and developing countries when it comes to voting rights in development banks,” criticises Kristina Lanz of Alliance SudExternal link, the think tank of Swiss development organisations. This is not surprising: Western states give money in return for having a say.

Birchmeier also sees it this way: “We invest a lot of money, so we also want to have a say on decisions and how things are run.” Switzerland has a particularly strong influence on projects that it finances directly.

Involving the private sector

Switzerland has made a substantial contribution to the World Bank’s controversial strategy, according to which the private sector should be involved in development aid.

“Switzerland was one of the first to say that the power of the private sector must be used in a targeted manner,” Birchmeier confirms. “However, we have always made it clear that it’s not a question of erratic deal-making but of transformation, that’s to say the creation of transparent markets in the medium term.”

In other words, the aim is not for individual companies to do as much good business as possible, but for the economy as a whole to develop.

NGOs criticise the fact that private companies are being mobilised for development aid.

“Companies want to minimise risks and maximise profits,” Lanz says. “But investments in the poorest countries are risky and many of the measures necessary to fight poverty, such as investments in education and health projects, are unprofitable.”

She says the World Bank is even trying to pass on the risks to the developing countries by promoting public-private partnerships. In other words, “profits are privatised, risks are nationalised”, she says.

Another contradiction is that private companies are legally obliged to maximise profits for their shareholders – unlike non-profit organisations. In many cases it’s hard to imagine that profit orientation and the public interest of development aid can be harmoniously pursued in parallel.

Even SECO can’t conclusively resolve this contradiction. However, SECO and Alliance Sud agree that local SMEs in particular should be supported and a dynamic local market created.

“There are certainly good and useful private investments,” Lanz admits.

Successes and criticism

According to the government, the World Bank Group has made a substantial contribution to reducing extreme poverty worldwide, from 41% in 1981 to 10% in 2015.

Lanz disagrees. “In the 1980s the World Bank even increased poverty through its structural adjustment programmes.” She is referring to the then widespread policy of fighting debt in developing countries, which aimed to bring the recipient countries into a free market economy, for example by privatising state-owned enterprises.

A mechanism still exists today: infrastructure is built – and fees are charged for its use. This becomes a problem when consumers are unable to pay the user fees because local wages are insufficient. This happens in particular when international companies build oversized, expensive infrastructure or when roads and energy supplies are privatised.

“In Mozambique, for example, more and more infrastructure is being financed through public-private partnerships. People suddenly have to pay tolls for road use and don’t know why,” Lanz says.

She says that after privatisation schools demanded school fees, which many parents can’t afford. A World Bank-sponsored public-private partnership to generate electricity in Tanzania led to higher electricity prices – in one year they rose by as much as 40%.

While the population might benefit from infrastructureExternal link, if people do not send their children to school because of the fees or no longer use the roads for trade, development is obstructed rather than encouraged.

“Of course, there are also good projects from development banks,” Lanz admits. “A lot of money has gone into renewable energies, for example the expansion of small solar panels has also been financed.” But she criticises that a lot of money is still going towards fossil fuels.

More

Millions pledged to support development banks

(Translated from German by Thomas Stephens)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.