Saying ‘no’ to OECD minimum tax ‘would be shooting ourselves in the foot’

A “yes” to the OECD minimum tax on large multinationals would ensure that additional tax revenue remains in Switzerland. So say supporters of an upcoming referendum on a bill to implement this corporate tax. Monika Rühl, director of business federation Economiesuisse, explains this position in an interview.

With the 15% minimum corporate tax, the OECD and G20 countries want to achieve global tax equity and combat international tax competition in one swoop. To implement it, OECD member state Switzerland must amend its constitution so the federal government can intervene in the tax sovereignty of the cantons with a “supplementary tax”. Voters will have the final say on June 18.

More

Explainer: the OECD minimum tax vote

SWI Swissinfo.ch: I’m sure you can tell us in three sentences why the people should approve this bill. What are they?

Monika Rühl: We need a ‘yes’ vote so that the additional tax revenue stays in Switzerland and doesn’t move abroad. Secondly, all cantons will benefit from these funds through the national financial equalisation system. And thirdly, Switzerland should remain an attractive business location in the future, because if big companies are here paying taxes, then everyone benefits.

More

‘Switzerland has shown a lack of solidarity on global tax equity’

SWI: Wouldn’t Switzerland also do further damage to its image if it failed to comply?

M.R.: In that scenario, the tax revenue would simply go to other countries. If we were to let that happen, we would be shooting ourselves in the foot. The money will only stay in Switzerland if we vote in favour of the bill.

SWI: The OECD minimum tax was lowered in the international debate from the originally intended rate of 21% to 15%. Some say that is too low. How do you respond to that?

M.R.: Around 140 countries have agreed on this 15% rate. All these countries are now implementing this agreement, as are we. Our country has every interest in keeping 15% of the profit of the large, internationally active companies in Switzerland and in using this revenue here.

If we do not implement the minimum tax, the additional tax will simply be levied abroad. Then we won’t see any of that money. Even the critics have noticed this. The Green Party gave their members the freedom to vote [on this issue] as they wish – some of their cantonal factions even called for a vote in favour [of the bill]. Prominent members of the Social Democrats are also in favour of the bill.

SWI: Switzerland was among the countries that called for a lower tax rate. What is your position on this?

M.R.: Attractive corporate taxes are an important factor in Switzerland’s success. They have led to steadily rising tax revenues. Now that an international agreement has been reached on a minimum tax of 15% for large multinational companies, there is a level playing field in international tax competition. The OECD’s guidelines for implementation are very clear, and they apply equally to all countries.

SWI: Some opponents say the profits of multinational corporations are in part generated in the Global South. Consequently, they say, the Global SSouth should receive a share of the taxes collected here. Does this argument seem justified to you?

M.R.: Even if development in the global south is a very justified concern, a share of corporate tax income is the wrong instrument for this.

SWI: What would be a better instrument?

M.R.: The countries of the Global South must become more attractive for investment. For that they need legal security and stable framework conditions. The Swiss government supports these countries with targeted projects through development cooperation.

There are reasons why most of the companies concerned are based in industrialised countries, where this minimum tax applies. Developing countries attract far fewer of them. But they do benefit from direct investment.

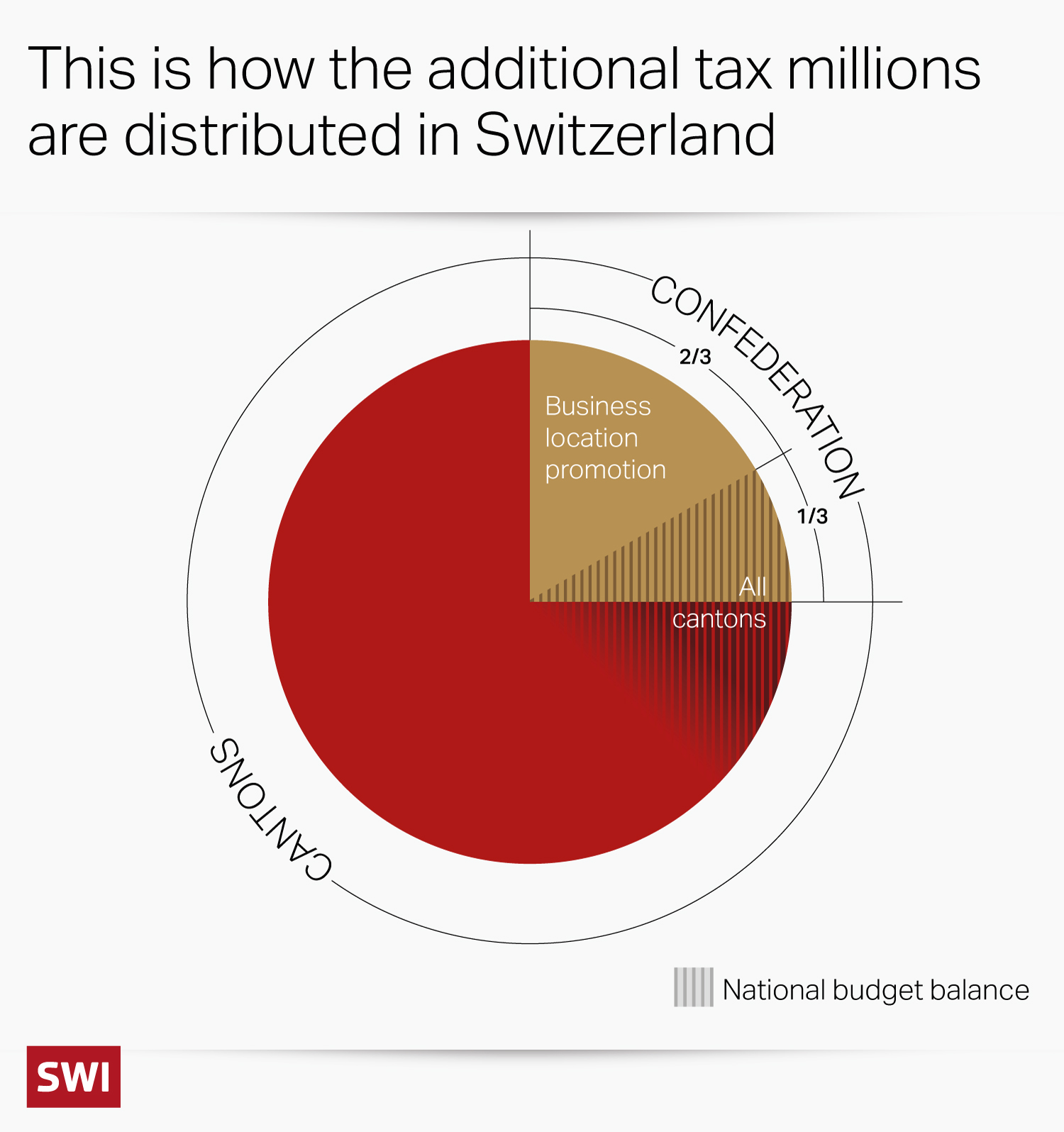

SWI: The way the additional tax money is to be distributed in Switzerland is also controversial. Not all cantons will benefit equally. Wouldn’t it be fairer if more money went into national financial equalisation?

M.R.: That is what’s happening. Let me make clear that the proposed distribution formula is supported by the federal government, by all the cantons, by the cities and by the municipalities. Through the tried-and-tested financial equalisation system, all cantons benefit from the additional revenue earned from the minimum tax. The more money goes into fiscal equalisation, the more the cantons that are beneficiaries of the system will receive.

And it’s important to take into account that the cantons that will now have to tax large companies at a higher rate will lose their attractiveness as [business] locations. So they need to be able to take other measures to remain attractive. How they do that is up to them.

They could, for example, promote research and development activities or subsidise day-care centres for children.

SWI: But this will stoke tax competition among the cantons…

M.R.: Quite the reverse. Tax competition will be curbed for large companies because the 15% rate will apply everywhere.

SWI: But the cantons where large businesses are based can use the additional money to reduce taxes elsewhere. This will intensify tax competition.

M.R.: If a canton proposes to do that, then a referendum could be called there first. Democracy also has a role to play in this.

SWI: Opponents also talk about tax loopholes. They say the Swiss tax system has instruments available to enable corporations to offset the OECD minimum tax. How do you respond to this?

M.R.: That is an assertion. After all, the OECD specifies how the minimum tax should be implemented. It will also monitor the implementation, which – just by the way – I personally find unappealing. So there is a monitoring system in place. It is not possible to circumvent it.

Translated from German by Catherine Hickley

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.