Swiss stamp duty reform dismissed at ballot box

Voters have thrown out a plan to abolish stamp duty on equity capital for Swiss companies, dealing a blow to the government and parliament.

Final results show 62.7% of voters rejecting the proposed reform, challenged by the political left in a nationwide referendum on Sunday.

The tax reform won a majority only in canton Zug, known as the seat of many multinational companies.

It is the second time in five years that the political left have succeeded in blocking corporate tax breaks.

Reaction

In a first reaction, Cédric Wermuth, co-president of the Social Democratic Party, said voters had been right to reject tax breaks for major companies following two years of pandemic crisis. The result is a mandate for parliament to take the concerns of citizens seriously and ensure the funding of the old-age pension scheme and health insurance premiums, he told Swiss public radio, SRF.

Thierry Burkart of the centre-right Radical-Liberal Party regretted that supporters hadn’t been able to convince voters that Switzerland could afford to scrap stamp duty on equity capital and that small and medium-sized companies and start-ups would have benefited.

Finance Minister Ueli Maurer appeared to downplay the defeat for the government, but he warned that Switzerland risked losing its competitive edge as an international business hub, if voters continued to deny necessary corporate tax breaks.

“Today’s result is not a drama, but it’s certainly not an encouraging sign for young companies,” he told a news conference.

Left-wing opposition

Parliament approved the reform last year but the Social Democrats, the Greens as well as trade unions collected enough signatures to try to veto the decision.

They argued that the main beneficiaries of the tax breaks are large companies and the financial industry but citizens would have to make up for the shortfall in revenue – estimated at around CHF250 million ($274 million) annually – by higher consumer taxes.

OpponentsExternal link have also dismissed the fiscal reform as a first step in a strategy by the government and parliament to deprive the state of much-needed revenue to fund public service tasks.

However, a majority in parliament, the government as well as the business community said the shortfall would be compensated in the long run by more investment in companies, notably start-ups.

Under current law, capital investment of more than CHF1 million is subject to stamp duty.

Switzerland is one of four countries in Europe to levy such a duty, according to the finance ministry. But opponents argue that the Swiss finance industry benefits from other tax breaks as transactions are exempt from VAT.

The stamp duty is owed to the federal but not to the cantonal and local authorities. It was introduced more than 100 years ago during the First World War and has been reduced several times over the decades.

The vote is the latest in a series of ballots over tax issues. Last September, voters clearly rejected a proposal by the Young Socialists to introduce a wealth tax on gains from dividends, shares and rents.

The political left has already launched a new attempt in a bid to stop the fiscal policies of the government and the centre-right majority in parliament. Voters are also likely to have the final say later this year on a plan to scrap the withholding tax on Swiss bonds.

Ban on tobacco advertising 56.6% Yes 43.4% No

State funding for private media 45.4% Yes 54.6% No

Ban on animal testing 20.9% Yes 79.1% No

Stamp duty reform 37.3% Yes 62.7% No

Turnout: 44.2.%

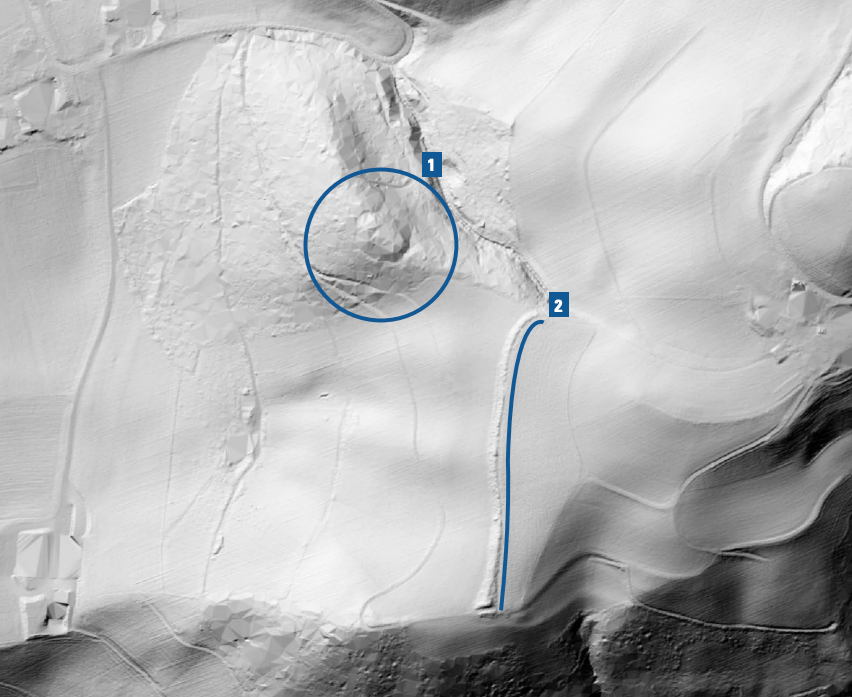

A series of votes at cantonal and local levels were scheduled on February 13.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.