Health insurance costs keep on rising

For adults living in Switzerland, health costs are expected to go up by 4% in 2018, the Federal Office of Public Health announced on Thursday. Many consider it a further blow to consumers.

Premiums for people under 18 will likely rise by 5%, and residents of western Switzerland are expected to be hit especially hard. For example, the rate is expected to go up by 6.4% in canton Vaud, and 5.4% in canton Geneva. At the other end of the spectrum, health insurance for people in canton Schwyz in central Switzerland will likely go up by 1.6%, with similar increases in nearby Uri and Nidwalden.

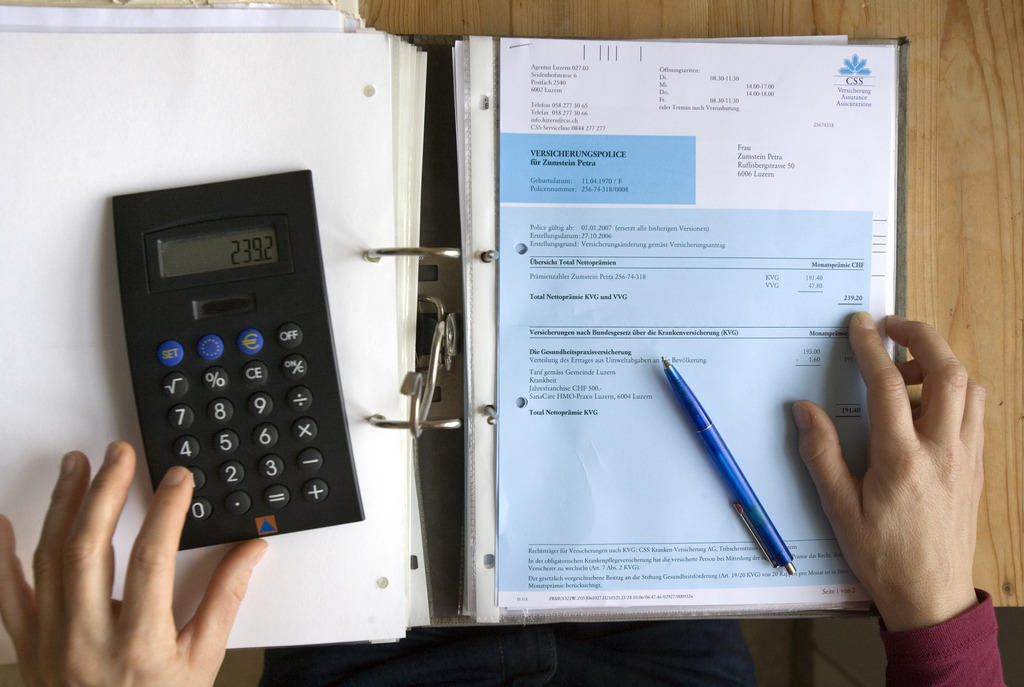

The increase applies to the standard, obligatory premium with an annual deductible of CHF300 ($308). The health officeExternal link says there are two reasons for the price hikes. For some insurers, reserves have fallen below the prescribed minimum, so these need to be rebuilt.

Other insurers need to catch up so that they can cover costs again. The impact of these two effects on premiums varies between health insurers and cantons.

Overall, the Swiss healthcare system is known for its excellent level of care, but is also among the most expensive in the world. Switzerland spends 11% of its gross domestic product (GDP) on healthcare, behind the US (17%), Netherlands, France, Germany and Canada.

News of higher premiums is likely to raise temperatures among the public, who have seen their health insurance payments double over the past two decades. The rise was 4.5% in 2017 alone, and on average, 3.7% per year over the past decade.

Model?

Switzerland’s healthcare system with its democratic, consumer-driven market, with the right to choose between over 60 different private insurance providers, has been held up as a model by countries like the United States.

Basic health insurance is compulsory for every resident in Switzerland, and many people opt to buy supplementary coverage.

More

Why there are 250,000 different prices for one health insurance

The insurance covers the costs of medical treatment and hospitalization, but the insured person has to pay part of the cost of treatment. This is done via an annual deductible ranging from CHF300 to CHF2,500 ($308-$2.563) for an adult as chosen by the insured person, and a charge of 10% of the cost above the excess up to CHF700 per year.

Per-capita out-of-pocket payments in Switzerland are therefore high: 60% more than in the US and almost three times as high as the Organisation for Economic Co-operation and Development (OECD) average.

A report published in January 2017 by consultants EY Switzerland put the average cost of a health insurance premium in Switzerland at CHF396. It expects premiums to double to over CHF800 by 2030, as households shoulder the burden of exploding health costs.

While 6% of monthly household income was spent on health insurance in 2014, this could rise to 11% by 2030, reducing purchasing power significantly, EY Switzerland said.

What can be done

The government has been trying to reduce health costs and health insurance premiums. It considers unnecessary treatments as causing a good part of the high health costs.

Santésuisse, the association of Swiss health insurers, also pointed out in comments made two days ahead of the health insurance announcement that too many people were going directly to hospital – where consultations are more expensive – instead of consulting their doctors.

Changes to the health insurance system have also been mooted. A proposal to have a single health insurer was however thrown out in a nationwide vote in 2014.

It may be some small consolation to those insured but there is a correlation between healthcare expenditures and life expectancy, one of the simplest indicators of the health of a population. Here we show that developed countries have massively increased their spending on health issues since 1970, and that life expectancy has followed the same upward trend, with varying degrees of success.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.