How to simplify Swiss customs with new app

Queuing at a Swiss border post to fill out paperwork and clear excess goods you want to bring into the country can be laborious. The new “QuickZoll” smartphone app aims to simplify the process for holidaymakers and cross-border shoppers, but it has certain limitations.

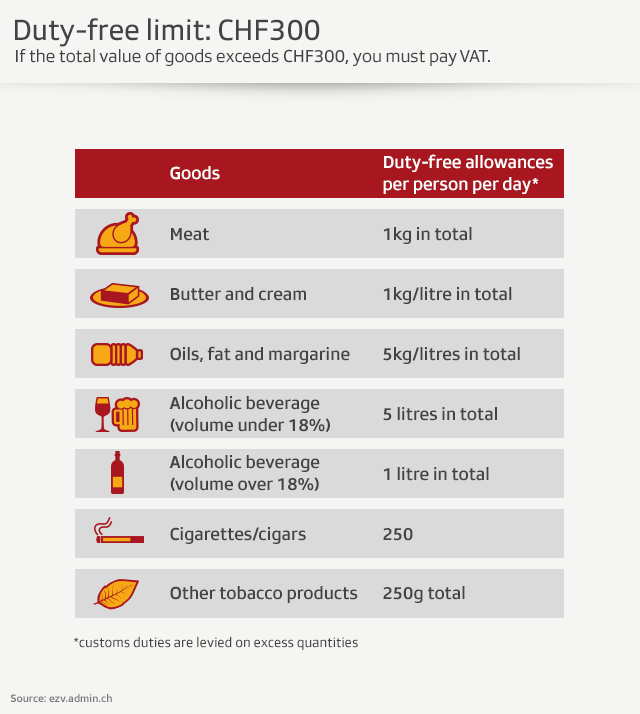

Since Easter, private individuals crossing into Switzerland can declare any purchases abroad at customs – over the official CHF300 ($302) duty-free limit – by downloading the Federal Customs Administration’s (FCA) free “QuickZoll” app. External link

The authorities want to make life easier for residents of Switzerland when making purchases abroad, but also hope to reduce their own costs. Every day, 750,000 people, 350,000 cars and 20,000 lorries cross Swiss borders. Innovations like the QuickZoll app aim to cut costs and improve efficiencies. The administrative burden of customs-related work is estimated at CHF470 million a year. The FCA estimates it should be able to save CHF125 million a year for cross-border goods traffic alone.

The procedure is relatively straightforward. Before crossing the border, you register on the app any goods you wish to import or gifts which were purchased abroad, and then you pay any applicable taxes and duties using your phone. Duty-free allowances, duties to pay and other customs issues are all explained in the app.

The FCA says the app has started well with 20,000 downloads so far.

“People are very happy to finally have a digital solution they can use on the way home, entering their products and paying the taxes in a few clicks before travelling into Switzerland. They don’t have to stop at the border anymore,” FCA spokesman Nicolas Rion told swissinfo.ch.

“If you are travelling from Berlin to Zermatt, for example, you probably don’t want to get off the train at the border in Basel and hop on the next one. This application makes life easier.”

Importing goods remains a hot issue with Swiss consumers, especially the high costs of importing by post and the CHF300 duty-free limit, which some people feel is unreasonably low.

While it is still early days, the QuickZoll app has generated a certain interest among swissinfo.ch readers.

“Great stuff,” wrote Maite Plimmer in reply to a question on swissinfo.ch’s Facebook page. She added that she would definitely use it “especially when crossing the border late at night by car”.

Reto Derungs agreed: “I love the idea of the “QuickZoll” customs app. I lived near the German border for years and often went shopping abroad.”

Robin Eymann, an economic specialist at the Federation of French-speaking Consumers (FRC)External link, felt the app had several strong arguments in its favour.

“It’s obviously positive to want to make life easier for consumers. And it’s also interesting to be able to see directly whether a product is subject to restrictions, customs taxes or VAT to be paid,” he declared, while adding that up to now there has been little demand for the app.

Despite its clean user-friendly interface, the app has several small constraints. It calculates the amount of VAT to pay based on a standard rate of 7.7% for all goods, which is higher than the 2.5% rate for food, medicines and books. The FCA argues that only 20% of declared goods typically fall under the lower rate, but this can still have a financial impact.

“On purchases of CHF500 this represents a CHF26 difference,” noted Eymann.

The FCA maintains that the app is not going to replace the traditional method of declaring goods at the border. If you want to ensure you get the lower VAT rate, you simply fill out a form at a border post.

Another restriction is that online clearance and payment must be carried out a maximum 48 hours before crossing the border. During the online process, you must specify a two-hour slot when you plan to cross back into Switzerland. Your smartphone receipt will then be proof of clearance and payment that may be requested by a customs officer.

In addition, the FCA stresses that the Swiss customs clearance procedure and VAT reimbursement steps required in countries where goods were purchased remain separate. If you return to Switzerland from Germany, for example, and wish to claim back VAT paid on items bought in Germany, you must still stop at German side of the border to complete the necessary written forms.

Finally, payments of duties and VAT via the app can only be made using a Visa or Mastercard credit card.

One concern raised by swissinfo.ch readers was possible high roaming charges when using the app abroad. Rion said this should not be a problem.

“You can use the app offline. The only internet connection you need is when you pay the taxes,” he explained. “You can do everything on the plane offline and pay just after landing, for example while waiting for your luggage to come. You just have to make sure that the taxes are paid before you cross the border.”

Going digital

The FCA insists the app is designed to make consumer’ lives easier despite these bugs. Rion said it gives a foretaste of what is on the horizon with the “DaziT programmeExternal link” – a CHF400-million project to simplify and digitize FCA services by 2026.

Customs is one of the largest federal departments, with a staff of almost 5,000 and an annual income of CHF21.5 billion in 2015 – roughly one-third of all federal income. Clearances by private individuals bring in CHF30 million.

By going digital, customs checks are also likely to become more targeted in the future.

“Many citizens simply don’t know that declaring at customs is something they should be doing,” said Rion. “Now with the app we are giving new visibility to the existing regulation which many people should but don’t know about. The excuse of not knowing or not doing anything is being reduced.”

But he insists Swiss customs does not have the resources or desire “to control every individual and every good that comes into Switzerland”.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.