Swiss Abroad: fog clears on tax reform in Thailand

The tax reform affecting Swiss emigrants in Thailand since January 1 contains a number of grey areas. The authorities have therefore clarified the situation in recent months, particularly with regard to the taxation of pensions.

Does the reform have an impact on second or third pillar payments? Has the double taxation agreement been amended? If you can prove that you are living off your savings, do you have to file a tax return? These are just some of the questions from the Swiss Abroad that we received after our first article on the tax reform that came into force in Thailand at the beginning of this year.

More

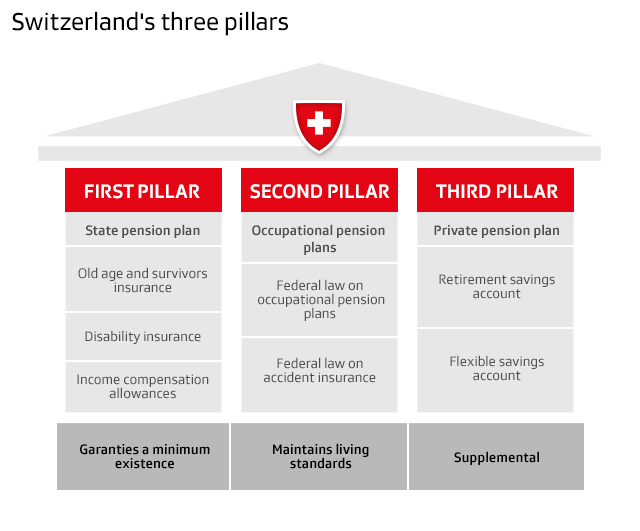

Explainer: the three Swiss pension pillars

Many of the 10,400 or so Swiss expats who will be living in Thailand by the end of 2023 have called for help to clarify the situation.

As a reminder, the tax reform drawn up by the Thai government stipulates that since January 1, 2024, resident foreigners, i.e. those staying in Thailand for at least 180 days a year, have had to pay tax on foreign income transferred to the country.

For example, a Swiss pensioner, single and without dependent children, earning the maximum old-age pension of CHF2,450 ($2,690) a month, with no second or third pillar contributions, would have to pay just under CHF3,000 a year in income tax.

However, only income earned since January 1, 2024, is affected. Anyone who can prove that their income predates this date will not be taxed on these sums, even if they were transferred to Thailand after December 31, 2023.

Thailand is also planning to exempt certain categories of foreign pensioners, in particular those with an LTR (long term visa), which is valid for ten years. To obtain this visa, you need to have a pension of at least $80,000 (CHF72,900) a year, or $40,000 a year and invest $250,000 in Thailand, in property for example.

What exactly is meant by income?

For Martin Liebenow, a German tax adviser and tax director at Mazars in Thailand, the country is merely applying a “light interpretation” of the World Income Principle. This principle defines that people who are subject to tax in one country (for example, because of their residence) are taxed on their worldwide income, regardless of where this income is received.

Since the reform was announced, however, there has been some uncertainty as to what the Thai tax authorities consider to be income. Section 40 of the tax of the same name now clarifies the situation.

Income from employment (including pensions),

Any money, property or advantage derived from a position or the performance of work,

Royalties from a business, copyright or any other right (will, deed, court order, etc.),

Income from interest, dividends and capital gains,

Income from property rental,

Income from the liberal professions,

Service contracts,

Income from business, commerce, agriculture, industry, transport or any other activity not specified in points (1) to (7).

“Thailand has decided to tax only money that is transferred to its territory. Income remaining in foreign accounts is therefore not taxable in Thailand,” Liebenow says.

By transfers, the authorities mean any bank transfer from a foreign country to a Thai bank, payments with foreign credit cards, repatriation of cash and use of online payment providers such as Stripe or PayPal.

To avoid any confusion, Liebenow advises having two bank accounts: one in which to invest your capital (i.e. past savings acquired before December 31, 2023) and the other into which to pay income earned from January 1, 2024.

What about the old-age pension?

Because of the ease of tax exemption and the relatively low cost of living, many Swiss people have chosen to spend their retirement in Thailand. The outcry was therefore particularly strong among this demographic when the tax reform was announced.

More

Do Swiss pensioners living abroad ‘milk’ the system?

It is now clear that pensions are considered as income and will be taxed, with some nuances depending on the pillar concerned.

Switzerland has signed a double taxation agreement (DTA) with Thailand. However, this agreement only applies to occupational pension provision (second pillar). Under Article 17, Thailand is responsible for taxing private second pillar income. This means that second pillar assets are taxed solely in Thailand, with no withholding tax in Switzerland.

Article 18 covers Swiss second pillar income under public law (i.e. for people employed in the public sector) and provides for exclusive taxation in Switzerland. If the taxpayer also has Thai nationality, however, they will be taxed in Thailand.

This agreement does not apply to old-age pensions (first pillar) or individual pension benefits (third pillar). This means that “each state may tax in accordance with its domestic law”, says the State Secretariat for International Finance (SIF). Swiss law does not provide for withholding tax on old-age (first pillar) pensions paid to non-residents, according to the SIF. However, it is possible to be taxed in Switzerland (at source) and in Thailand on third pillar assets.

If you are taxed in both countries, “you should ask the Swiss body that makes the deduction to issue a withholding certificate in English, which proves how much tax you have paid”, advises Martin Liebenow. “This will enable you to deduct this amount from your tax in Thailand.”

Finally, for the SIF, “the only thing that has changed is the fact that Thailand has, in the past, failed to exercise a right of taxation to which it is entitled under the DTA, which has led to years of double non-taxation”.

Don’t play with fire

According to information Liebenow obtained from the Thai Revenue Department, tax return forms should be available in December 2024. The deadline for filing returns is March 31, 2025. “There will be no extension of time. And any delay will be penalised,” he warns.

To file their tax returns, Swiss nationals in Thailand will need an International Tax Identification Number (ITIN), which they can obtain from their local tax office. If you have no income to declare, for example because you are living off past savings, you are under no obligation to obtain such a number.

Although the reform is likely to take several months to implement, Liebenow urges anyone affected by it not to try to slip under the radar. “Not registering with the authorities would be tantamount to committing premeditated tax fraud, which is a criminal offence,” he says.

More

Welfare for Swiss expats: fewer but increasingly complex cases

So why this reform at all?

Thailand wants to become a member of the Organisation for Economic Co-operation and Development (OECD). As such, the OECD is putting pressure on Thailand to regulate its method of taxation, so as not to “look like a tax haven on a par with the Cayman Islands and Bermuda”, Liebenow says.

What’s more, by maintaining a system that made it easy to avoid paying income tax, Thailand deprived itself of a substantial gain. It now intends to remedy this situation. However, the government has given no indication of how much it hopes to collect from the new tax.

Where can I find more information?

Liebenow urges everyone concerned to consult a fiduciary in Switzerland or Thailand to clarify their personal situation, as each case is unique.

To get an idea of the amount to be paid, he recommends using the calculation tool provided by an asset management company.

Information is also available on the Swiss Society of Bangkok website in German and French. The Swiss Embassy in Bangkok organised a question-and-answer session with several representatives of the Thai Revenue Department.

Edited by Samuel Jaberg. Adapted from French by DeepL/ts

More

Ageing expats cause headache for government

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.