Swiss investors still leaning heavily on fossil fuels

The Swiss financial market invests too much in oil and coal production, according to a review of nearly 200 financial institutions.

Some 80% of the banks and asset management firms surveyed by the report have coal mining companies in their investment portfolios.

“On average, the Swiss financial centre thus supports additional expansion of international coal and oil production,” announced the Federal Office for the Environment (FOEN) on Monday. This contradicts the national climate goals, it said.

More

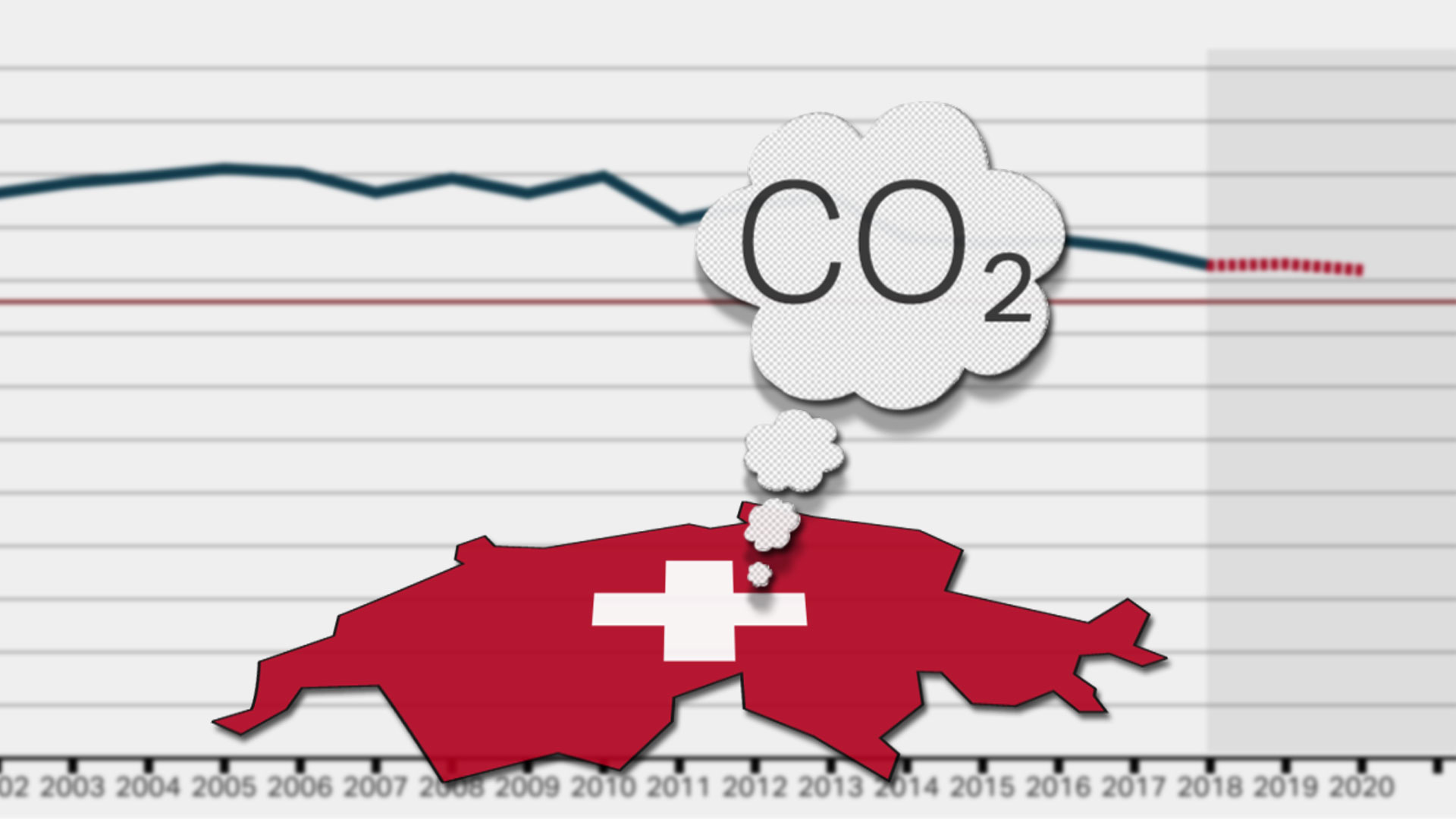

Switzerland misses the greenhouse gasses target

Today the Swiss financial centre invests four times more in companies that generate electricity from fossil sources such as coal and gas than it does in producers of renewable electricity. Aside from the climate-related concerns, the FOEN pointed out the potential financial risks for those investing in fossil fuels – which could become less attractive due to future climate policy measures.

The FOEN also noted that more than half the institutions claiming to exclude coal from their investments still hold shares and bonds in companies that mine coal or produce coal-based electricity.

The conclusions come from a voluntary review initiated by the FOEN in cooperation with the State Secretariat for International Financial Matters (SIF). The climate compatibility test, based on the international PACTA method (Paris Agreement Capital Transition Assessment), covered the entire Swiss financial market for the first time. The last test in 2017 was only open to pension funds and insurance companies.

The aim of the test is to create transparency and to support the efforts of financial institutions to steer their investments into climate-friendly paths, the FOEN wrote in its press releaseExternal link. The results showed some initial progress, but not enough for the Swiss financial centre to play a leading role in the area of sustainable financial flows.

More

Making the Swiss financial sector deliver on climate promises

Climate-friendly renovations

Pension funds, which have many real estate holdings in their portfolios, could make an important contribution to climate targets if they implement planned building renovations, the report found.

Such funds are currently planning to convert 30% of their buildings from fossil to renewable heating systems, which could have a major influence on the direct reduction of emissions.

The other financial sectors, on the other hand, would only consider this for 1-2% of their properties, the report wrote.

WWF Switzerland promptly issued a media release accusing the Swiss financial sector of “fuelling the climate crisis”. According to Stephan Kellenberger, the group’s expert for sustainable finance: “Our banks, insurance companies and pension funds continue to finance, insure and invest far too much in economic activities that threaten our climate – and thus our very existence. It is time to make sustainable finance their top priority.” Greenpeace, meanwhile, is calling on banks and insurance companies to set binding climate goals.

Methodology

The Pacta (Paris Agreement Capital Transition Assessment) climate impact test is based on a standardized analysis of global equities, corporate bonds and credit portfolios. The test was developed by the international and non-profit think tank 2°Investing Initiative.

In the test, the production plans of the companies in the portfolios are compared with the development required by the International Energy Agency (IEA) to limit the maximum warming to 1.5° Celsius.

The analysis covers the extraction of fossil fuels, power generation, transport (automobile production, shipping and aviation) and industry (cement and steel). According to the FOEN, it is also possible to examine how well the Swiss real estate market performs in terms of climate targets.

More

Swiss sustainable finance: world leader or wishful thinking?

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Join the conversation!