Details of Swiss-US banking deal outlined

Switzerland and Washington have signed an accord which allows Swiss banks to cooperate with US authorities to end a long-standing dispute over tax dodging. The deal is seen as a watershed, but leaves open a number of legal issues.

A joint statement, signed in Washington on Thursday by the Swiss ambassador to the US and a senior official in the US Department of Justice (DoJ), defines the framework for the cooperation, respecting Switzerland’s legal system and sovereignty, notably the country’s banking secrecy rules and data protection.

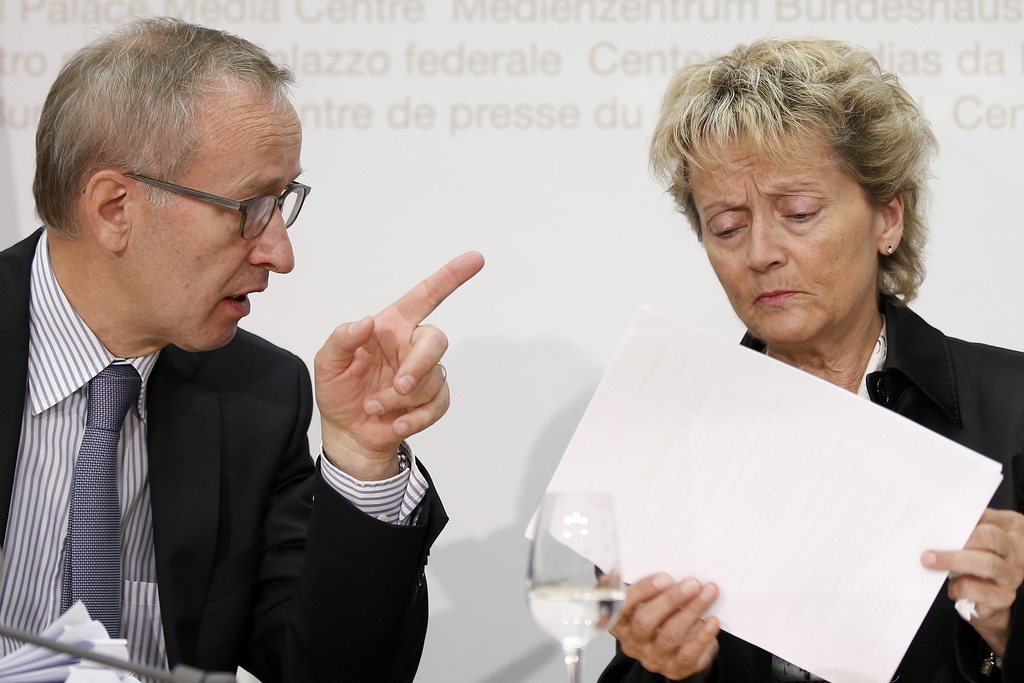

“It is the best possible result. We can live with it,” commented Finance Minister Eveline Widmer-Schlumpf at a news conference in the Swiss capital, Bern, on Friday.

She said that Switzerland would do its best to encourage banks to participate in the programme. It allows them to “turn the page”, avoiding further uncertainty and instability which risks undermining the competitive edge and damaging the reputation of the Swiss banking industry.

Parliament

Widmer-Schlumpf added that the agreement falls short of a government-sponsored accord which was rejected by parliament in June. Intense negotiations with Washington since then helped avoid harsh recriminations by the US authorities, according to the finance minister.

“The political actors have played their part for now,” she said. But she did not rule out that the government might have to intervene again if legal appeals against the handing over of banking data threaten to block settlements between the US and individual banks.

Banks have until the end of this year to avoid or defer prosecution by the justice authorities in the US.

2009: Switzerland’s biggest bank UBS agrees to turn over more than 4,450 client names and pay a $780 million fine after admitting to criminal wrongdoing in selling tax-evasion services to wealthy Americans.

July 2011: The second-biggest bank, Credit Suisse, comes under criminal investigation by US. The bank later makes a provision for a potential fine of CHF295 million.

February 2012: US justice department indicts Wegelin, Switzerland’s oldest private bank, on charges that it enabled wealthy Americans to evade taxes on at least $1.2 billion hidden in offshore accounts.

June 2012: US treasury department reaches a tentative agreement with Switzerland to help banks comply with US tax evasion regulations.

June 2012: Bank Julius Baer hands 2,500 employee names to US authorities in a bid to free itself from the tax probe, according to lawyers.

August 2012: Global bank HSBC hands over details of current and former employees to the US authorities.

November 2012: Private bank Pictet confirms it is also under investigation by the US.

December 2012: Two bankers and one former employee of the Zürcher Kantonalbank charged by US, accused of helping US clients avoid taxes.

January 2013: Wegelin private bank shuts its doors, following a guilty plea to charges of helping wealthy Americans evade taxes through secret accounts. It agrees to pay nearly $58 million in fines on top of $16.3 million in forfeitures already obtained by the authorities.

May 2013: Swiss government presents bill to parliament that would let Swiss banks hand over internal information to US to avoid threatened criminal charges – though the banks still face fines likely to total billions of dollars.

The bill aims to save the banks from heavier punishment in the United States for helping wealthy tax cheats, by sidestepping its secrecy laws to let bankers disclose data to US prosecutors.

June 2013: Parliament rejects the so-called Lex USA bill, telling the government to make the decision.

July 3, 2013: The government announces a new data transfer framework for banks. Finance Minister Eveline Widmer-Schlumpf presents a “plan B”, under which banks which cooperated with the United States authorities would be deemed not to have violated Article 271 of the penal code, which forbids collaboration with foreign authorities.

August 29, 2013: Swiss and US governments sign deal, and announce details.

Criteria

The agreement defines different criteria for cooperation. Fourteen banks – two more than previously known – are excluded from the programme as they continue to be under criminal investigation.

Among them are the country’s second biggest bank, Credit Suisse, at least two state-backed cantonal banks as well as private banks Julius Baer, Pictet and the Swiss arm of Britain’s HSBC.

Banking giant UBS in 2009 paid a $780 million (CHF720 million) fine and handed over 4,500 client names to the US authorities.

Two private banks, including Wegelin, were forced to close down.

The remaining about 300 banks will be divided into three groups. The fines they face range from 20 to 50 per cent of the total amount of hidden US assets in Swiss accounts up to August 2008 – when the US started cracking down on tax avoidance by Americans – and from March 2009, respectively.

Michael Ambühl, the outgoing secretary of state in the finance ministry who negotiated the settlement, said the programme would be completed within two years.

He refused to speculate on the amount of the financial penalties, but he did not rule out that small banks which specialised in tax avoidance might find themselves in troubled waters.

Double taxation accord

According to the DoJ, eligible banks will pay penalties and disclose account information about US customers in order to avoid prosecution.

“The programme’s requirement that Swiss banks provide detailed account information will improve our ability to bring tax dollars back to the US Treasury from across the globe,” Attorney General Eric Holder said.

The accord creates significant risks for taxpayers, banks and advisors that continue to fail to cooperate, the DoJ noted.

Observers have pointed out that the agreement might speed up ratification of an amended double taxation agreement between the US and Switzerland. It is the basis for legal assistance required for the disclosure of clients’ names. The protocol has been blocked in the US Senate since 2009.

More

Bank it

Reaction

The Swiss Bankers Association said Thursday’s agreement was the only possible solution to end the long-standing tax dispute, but it warned of serious financial consequences as a result of the fines.

“It will be a painful programme but one that brings some certainty to Switzerland, to the financial sector, to the clients and to bank employees. In this respect it is better to have this programme than none at all.

“We will implement it in good faith in a proactive and constructive way with the US Department of Justice,” SBA chairman Patrick Odier told swissinfo.ch.

He added that the dispute left a slightly sour taste in the mouth.

“There should have been the means to ensure that there was more trust in the discussions, but that was not the case. The financial sector as a whole has yet to regain full trust and credibility and this explains why the US has taken the decision to penalise Swiss banks so harshly,” he said.

Reaction among Switzerland’s main political parties was mixed.

The centre-right Radical Party, which is traditionally close to the business industry, described the accord as “ugly and expensive”, but better than an initial deal rejected by parliament.

The centrist Christian Democrats for their part said the accord was worse than the deal rejected in June, while the rightwing Swiss People’s Party accused the government of kowtowing to the US.

The centre-left Social Democrats have welcomed the deal in principle, but remain sceptical that it can go ahead without violations of the law.

(With input from Matt Allen)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.