Sarkozy opens WEF with calls for regulation

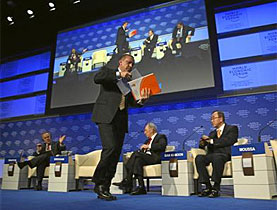

French President Nicolas Sarkozy has offered a broad riposte to unrestrained free-market capitalism at the World Economic Forum (WEF) meeting in Davos.

Sarkozy, giving the keynote address on Wednesday, told the business and political movers and shakers gathered in the Swiss resort to prepare for tighter regulations including new accounting rules and executive pay limits.

He said the risks were too great if “we do not change the regulation of our banking system and the rules for accounting and prudential oversight”.

He expanded his criticism to target what he considered reckless free trade, profits without job creation and currency manipulation.

“Finance, free trade and competition are only means, not ends,” Sarkozy said. “From the moment we accepted the idea that the market was always right and that no other opposing factors need to be taken into account, globalisation skidded out of control.”

Sarkozy’s opening address followed the traditional welcome by the Swiss president, Doris Leuthard.

In her speech, Leuthard, who is also economics minister, predicted dark times unless words were converted into action, criticising the “gap between rhetoric and reality”.

She also urged politicians, the business community and above all bankers not to return to pre-crisis habits.

“Take your responsibilities seriously and support strategies that lead to sustainable growth,” she said.

“What are we waiting for? The new century has begun with a terrible economic and financial crisis and people need jobs and income. We’ve done enough talking – now it’s time to act.”

Prickly issues

The mood at the 40th WEF Davos meeting was less sombre and fraught than last year, when embattled company executives were repeatedly forced to dodge brickbats hurled from the audience.

Having previously contrived to wreck the global economy, business leaders and politicians approached this year’s event with the intention of rolling up their sleeves to “rethink, redesign and rebuild” from the ruins of the financial crisis.

However, panel members were still confronted with some prickly issues in the early rounds of sparring, such as executive pay, draconian regulations and the possibility of a return to global recession.

This year also saw the return of several United States banking executives who had been cowed into forgoing the expensive trip across the Atlantic in 2009. They had been given plenty to talk about by US President Barack Obama’s recent plans to make their banks hand back taxpayers’ money.

The glamorous parties of yesteryear were still absent – or scaled back – as financiers instead gathered behind closed doors with regulators and politicians to hammer out ideas of how to produce a coherent global regulatory response to the banking crisis.

Regulatory upheaval

Indeed Leuthard and Sarkozy were speaking just hours before Obama’s first State of the Union address, where he is expected to address reforming Wall Street. Bankers at Davos, however, disagreed.

“Let’s get good regulation, better regulation, but not more regulation,” said Lord Levene, chairman of British bank Lloyds.

Peter Sands, CEO of Britain’s Standard Chartered Bank, added that his industry had already been “fundamentally changed” by tighter regulations and supervision, while Deutsche Bank chairman Josef Ackermann said everyone would lose out if governments clamped down on markets too zealously.

“The pendulum might have swung too far,” Swiss-born Ackermann warned. “Consistent and global rules, and a level playing field, are absolutely key to the global economy.”

Sarkozy, however, called for a regulatory and cultural upheaval.

“The signs of recovery that seem to herald the end of the global recession would not encourage us to be less daring. Rather, we must be even bolder,” he said, calling for better economic governance, worker protection, public debt reduction and rules against tax evasion.

He called for stimulus packages to be withdrawn slowly so they didn’t alarm jittery markets. But he laid down the gauntlet to chairmen and CEOs in attendance by saying excessive profits and pay packages would “no longer be tolerated”, calling it “morally indefensible” when companies that “contribute to destroying jobs and wealth also earn a lot of money”.

The comment drew a lone clap, while the rest of the hall stayed silent.

Ethical crisis

Earlier on Wednesday a WEF poll revealed that two-thirds of people around the world thought the global economic crisis was also a crisis of ethical values that called for more honesty, transparency and respect for others.

Almost as many named business as the sector that should stress values more to foster a better world.

Only 12.9 per cent of the 130,000 people polled said businesses were primarily accountable to their shareholders.

“The poll results point to a trust deficit regarding values in the business world,” the WEF said in a statement. “Only a quarter of respondents believe that large multinational businesses apply a values-driven approach to their sectors.”

Asked which values were most important in the global political and economic system, 39.3 per cent said honesty, integrity and transparency, 23.7 per cent chose respecting others, 19.9 per cent said considering the impact of actions on others and 17 per cent said preserving the environment.

Matthew Allen in Davos, swissinfo.ch and agencies

The World Economic Forum started life as the European Management Forum in 1971.

Formed by German-born businessman Professor Klaus Schwab, it was designed to connect European business leaders to their counterparts in the United States to find ways of boosting connections and solving problems.

It is a non-profit organisation with headquarters in Geneva and is funded by the varying subscription fees of its members.

The forum took its current name in 1987 as it broadened its horizons to provide a platform for finding solutions to international disputes. WEF claims to have helped calm disputes between Turkey and Greece, North and South Korea, East and West Germany and in South Africa during the apartheid regime.

WEF conducts detailed global and country specific reports and conducts other research for its members. It also hosts a number of annual meetings – the flagship being Davos at the beginning of each year.

In 2002, this meeting was moved to New York for a one-off change of venue to support the city following the 9/11 terrorist attacks of the previous year.

Davos has attracted a number of big names in the world of business, academia, politics and show business. These include: Nelson Mandela, Bill Clinton, Tony Blair, Bono, Angela Merkel, Bill Gates and Sharon Stone.

As the forum grew in size and status in the 1990s, it attracted rising criticism from anti-globalisation groups, complaining of elitism and self-interest among participants.

The 2010 Davos meeting will attract 2,500 delegates from 90 countries. It takes place from January 27-31.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.