Surfing the trend of sustainable supply chains

Haelixa is to supply chains what forensic DNA experts are to crime scenes.

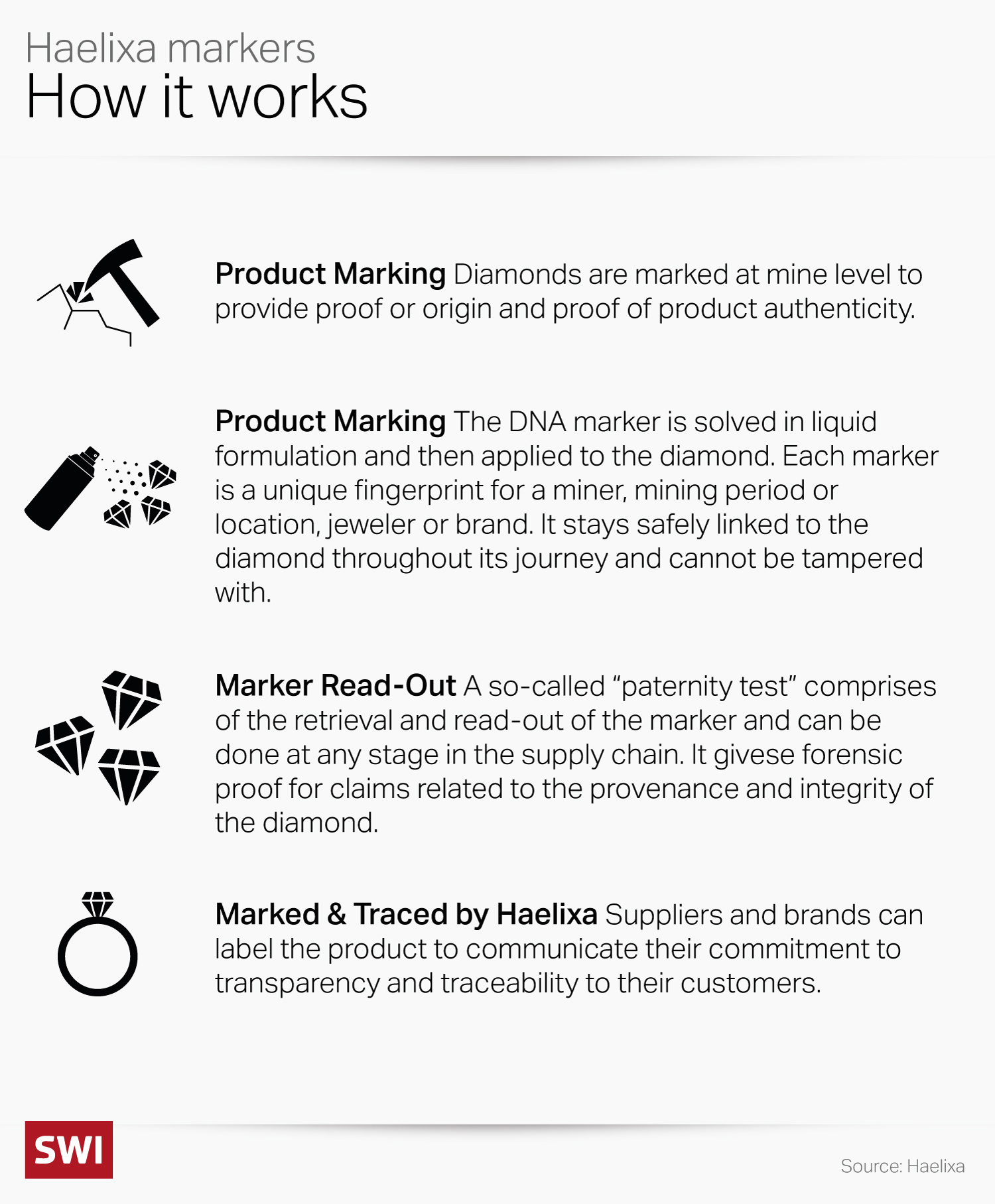

The ETH Zurich spin-off has developed a patented solution that it hopes will become the gold standard of physical traceability. It is based on a DNA marker that can be placed on raw materials such as precious metals or textiles without leaving a visible trace.

“Globalised production and lack of supply chain visibility are the causes of many of the environmental, economic and social problems that we collectively face,” says Haelixa CEO Michela Puddu, a stylish Rome native who came to Switzerland to study chemical engineering and stayed.

Her love of fashion paved the way to her thinking about the environmental implications of clothes: the fashion industry accounts for 10% of humanity’s carbon emissionsExternal link and most garments end up incinerated or in landfills. That same line of questioning led her to address the supply chains of gold, and gemstones.

Puddu, along with Haelixa co-founder Gediminas Mikutis, developed DNA markers for product traceability while pursuing a PhD at the federal institute ETH Zurich. The markers are invisible to the naked eye and applied at the start of the supply chain. A forensic test based on PCR, the same biomolecular lab technique used to test for Covid-19, is used to verify the product identity at any step of the supply chain. Product identity could refer to origin or whether a product is recycled or organic.

“The beauty of using DNA… is that you can have a unique identifier for every client, for every product,” says Puddu before providing a tour of the company’s luminous labs. “We can produce an infinite number of distinct DNAs to distinguish whatever you like: each individual mine, each individual supplier, each individual product or collection.”

For example, if a mine in Chile wants traceability, Haelixa assigns them a unique DNA that will only be associated with that specific mine. If that synthetic DNA is found again by doing forensic testing at a refinery in Switzerland, it means the gold came from that mine and no other. The same principle applies to tracing the complex journey of cotton.

“In a crime scene you do DNA testing, in diagnostics you do DNA testing, so it is an extremely reliable test,” she notes. “And obviously when it comes to supporting product claims to satisfy authorities’ or customs’ request, that’s extremely important because you have a really solid test that is also tamper-proof: you need to know the DNA sequence assigned to a product to be able to screen for it.”

Switzerland is home to several companies focused on digital (QR/blockchain) and physical product traceability solutions pertinent to different sectors. Haelixa to date has focused its solution on three fronts: precious metals, fashion and food. The company does not share revenue figures.

The main office of Haelixa sits in a cubic, oak-colored building facing the train station of Kemptthal, a district between Zurich and Winterthur. The structure used to house the former factory of Maggi, a world-famous brand for precooked soups and sauces that was absorbed by the Swiss multinational Nestle, which boasts a shop down the street from Haelixa. The area has been dubbed “The Valley” because of its high concentration of innovative companies. Inside, rooms are named after key commodities like cotton and coffee.

“Each sector has its unique issues,” explains Puddu. “In gold, the challenge is mainly about provenance. Fashion is about the origin but also fiber identity, quality, and performance… There is also potential material mixing happening at any point, which adds a layer of complexity.”

Haelixa fits into a small but growing constellation of innovative companies tackling supply chain traceability, viewed as essential to meeting global industry and individual company-level sustainability goals. Physical product traceability technologies have developed rapidly over the past decade.

The boom has been driven by regulatory requirements for pharmaceuticals (United States, 2013), tobacco products (European Union 2014), and medical devices (EU, 2017). The European Union’s Green New Deal mandates digital product passports for a wide range of industries and products. The latest push came in March with the EU Green Claims Directive, which will require brands to back up sustainability claims and penalise greenwashing.

“Brands who wish to continue their sustainable narrative will need to be more transparent about their supply chain, and to do so they will need to be able to trace back their products (from the sourcing of raw materials to its end-of-life) if they want to avoid hefty fines,” notes James Crowley, innovation analyst at Fashion for Good, an Amsterdam-based NGO.

Passion for fashion

Fashion provided Haelixa with an entry point to the traceability business and represents the bulk of revenues.

“The apparel supply chain is notoriously fragmented and complex making tracing garments to their origins a difficult and laborious task,” notes Crowley, one of the authors of the Tracer Textile Assessment report looking at tracer technologies used by farmers, manufacturers and brand in the textile supply chain. Haelixa is one of 17 companies identified in the report as working in this space.

Founded in 2016, Haelixa says it helps trace about 20 million garments of clothes per year. Tracer technologies, which give physical evidence of geographic and supply chain origin, are seen as instrumental to the industry’s broader efforts to meet sustainability standards and lend credibility to product claims such as “organic” or “recycled.”

Most standards relating to fabrics rely on mass balance, explains Ms. Puddu, with measurements taken at the beginning and end of the supply chain. Maintaining a balance of volume across the supply chain helps prevent, for example, selling more organic cotton than is produced. But this chain of custody model is not fool proof, as other materials can be mixed in along the way. “Even if the volume at the beginning and at the end of the supply chain is the same, that doesn’t prove the material is still the same,” she says.

Haelixa assigns a unique DNA to every client, to every product, to every location. The DNA marker survives the whole supply chain journey from fiber to jeans or T-Shirts and remains detectable in the final garment. A syringe flushes a special formula through clothing and the liquid collected on the other side undergoes the PCR test.

“You can think of it as a Covid test for garments,” says Puddu. “If the unique DNA Is not there, then it is just not there.”

She argues her technology is better than visible product identification tags that are finite or can be faked. Crowley says the strong suit of physical additive tracers – the innovation category Haelixa falls under – is that they facilitate better direct “track and trace” traceability and are more tailored to the user. However, he notes, there is a higher supply chain operational burden compared to some of the other next generation options.

But are consumers willing to pay more for transparency? “The brunt of the costs is given to suppliers and brands,” notes Crowley. “Consumers may be passed on some costs, but this would be hidden within a small percentage of the price margin of the end product.”

Puddu points to a KPMG surveyExternal link that estimates that worldwide nearly two in three consumers (64%) supports sustainable fashion and 13% are willing to pay a premium of 25% for sustainable fashion items. Four in five brands and retailers – and a similar ratio of suppliers – plan investments of at least $100,000 (CHF89,000) in the next three years to boost supply chain transparency.

Researchers at global consultancy Bain&CompanyExternal link found that about 15% of fashion consumers around the world “consistently make purchasing decisions” to lower their environmental impact. They also concluded that more would do the same if offered clearer information on product durability and environmental impact by apparel companies.

Gold refiner Argor-Heraeus uses the technology offered by Haelixa to trace the journey of gold doré bars from South American mines (and beyond) to Switzerland. Because the bars receive a unique DNA marker specific to the mine site, a forensic test can confirm provenance when the bars reach the refinery in canton Ticino. The verified bars are refined on a dedicated production line that feeds the vaults of Zürcher Kantonalbank, a local bank.

About three quarters of global gold bar production happens in Switzerland. The sector does not shine for its transparency but that is slowly changing. Investors and consumers are pushing for gold supply chains to conform to ethical standards and environmental guidelines, primarily those spelled out by the London Bullion Market Association or the OECD.

“Traceability and transparency across the entire supply chain of gold and other precious metals are gaining in importance.” says Drazen Repak, head of trading banknotes and precious metals and Zürcher Kantonalbank, which connected Haelixa to Argor-Heraeus. The financial institution is one of Haelixa’s key investors, along with Switzerland-based Verve Ventures and Clariant AG, a Swiss venture capital firm and multinationals specialty chemicals company

Haelixa reports tracing more than ten tonnes of gold annually – a solid start considering that Switzerland imported an average 8.6 tonnes per month in 2021 and 9.3 tonnes per month in 2022.

“The technology applied is still relatively new to the market,” explains Repak in an emailed statement. “As such, the current traceable gold volume is still comparatively low. However, we have seen a clear increase in demand for traceable gold in recent months. As a rough indication, the cost for DNA application and testing accounts for less than 0.1% of the refined product value.”

Haelixa is not the only solution in play in the sector. Metalor, for example, has opted for a so-called geo-forensic passport, developed at the University of Lausanne, to validate the origin of doré reaching its refinery. Haelixa plans to branch out to other metals and has partnered with Lucerne-based Gubelin on a provenance proof initiative for diamonds and emeralds.

Regulations on the horizon

Upcoming regulation in Europe on corporate due diligence and as well as on the textile industry specifically bode well for companies like Haelixa. The European Union has laid out a strategy to make textiles more sustainable (by making durability part of design requirements) and circular (meaning clothes are recycled or upcycled rather than thrown in the trash). It envisions Digital Product Passports on garments by 2025.

France has charged ahead with compulsory eco-labelling for large companies with a turnover over 50 million euros as of January 2023. This means consumers must be provided with information on the product’s reparability, recyclability, recycled material content, use of renewable resources, traceability and the presence of plastic microfibres. This can be done on a QR code on a T-shirt tag or through dedicated product webpages.

Fashion is a three trillion-dollar industry. The so-called ethical fashion market is slowly gaining ground. It reached a value of nearly $7,548 million in 2022, having grown at a compound annual growth rate (CAGR) of 6.5% since 2017. The market is expected to grow to $11,122.2 million in 2027, according to the Business Research Company.External link

“There are a lot of changes happening in the textile industry which is transitioning from a fairly unregulated sector to actually quite a regulated one,” says Ms. Puddu. “Any claim that something is green has to be backed up.”

Even though the Responsible Business Initiative was rejected at the ballot box in 2020, Puddu sees strengthened support for the cause and increased relevance of the topic in Switzerland. Haelixa already works and partners with several Swiss companies, including Spoerry, a maker of luxury cotton yarns and blends in Flums, Rheinhart, the brands FTC cashmere brand and Nikin, WEBA, a premium manufacturer supplying several brands, including Hugo Boss.

Haelixa has also entered a partnership with Rieter, a machinery provider for spinning cotton based in nearby Winterthur. The partnership is focused on creating an add-on for the spinning machinery made by Rieter that would spray the patented formulation of Haelixa. The goal is to automate the process, which would facilitate scalability.

Puddu’s next frontier is food supply chains. The food traceability market was worth 18.15 billion in 2021 and is projected to grow to $35.48 billion by 2029, according to Polaris market researchExternal link. She says the initial feedback from regulatory authorities in Switzerland and the US for her product is positive. Haelixa needs regulatory clearance in Europe to go commercial.

“We want that this technology inspires the world to make responsible choices,” says Puddu.

Edited by Virginie Mangin

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.