Expert doubts Syrian leader has Swiss stash

Swiss financial crime expert Daniel Thelesklaf has told swissinfo.ch he seriously doubts Syrian President Bashar al-Assad has assets hidden in Swiss banks.

Switzerland announced on Tuesday it was extending sanctions against Syria to include travel bans and asset freezes against Assad and nine senior officials, in a move that follows the European Union and the United States.

Syria is Switzerland’s fifth major case of frozen assets this year.

So far it has frozen SFr60 million ($69 million) belonging to former Tunisian dictator Zine el-Abidine Ben Ali and his clan.

It has also identified about SFr400 million belonging to former Egyptian President Hosni Mubarak and his close entourage and some SFr360 million belonging to Libya’s Moammar Gaddafi and his clan. Switzerland has also frozen SFr70 million in assets belonging to former Ivorian president Laurent Gbagbo and his entourage.

Thelesklaf, who is executive director of the Basel Institute on Governance, recently accompanied a Swiss delegation to Egypt and Tunisia as an independent observer to discuss the return of any illicit funds held in Swiss banks.

swissinfo.ch: Do you think Assad and his clan have a secret Swiss fortune stashed away?

Daniel Thelesklaf: I would be very surprised if Assad held assets in Switzerland. That would be a very weak signal.

I have no idea about the possible size of the assets, but I would be surprised if a direct link to Assad could be detected. His negative track record is well known.

Also, Swiss banks must have considered the fact that the US government had sanctioned Syrian banks in the past and had most probably increased their scrutiny with regard to clients from that country a while ago.

swissinfo.ch: The new Tunisian and Egyptian governments have filed applications with Switzerland to begin the process of unblocking assets, but the requests were rejected as incomplete. How soon will any money be returned?

D.T.: The original requests from the two countries have come at a very early stage. There was a clear political signal to show willingness to follow up the assets. Of course they were incomplete at such an early stage, nothing else can be expected. But it was not a formal rejection of the requests.

Switzerland got back to them to tell them the additional information they needed and I’m sure they are working on providing this information. This is a normal procedure.

But once the assets are identified and accounts frozen, before you can hand over documents and confiscate assets, the account-holders will have the opportunity to lodge a complaint and they will argue that they have legitimately earned the assets, there is no due process in the country of origin or their human rights are violated. They will have all kinds of arguments, so realistically it will take a few years before these assets can be returned.

swissinfo.ch: Since February Switzerland has a new law on returning illicit dictator funds. Have all legal loopholes now been closed?

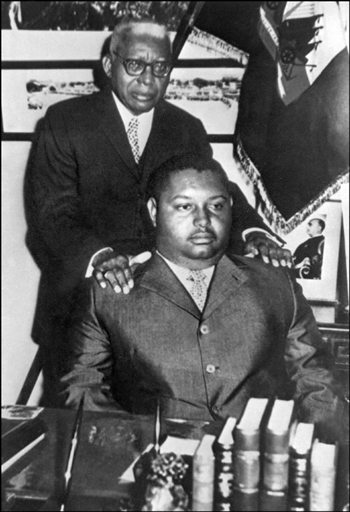

D.T.: The ultimate aim of the law was to find a solution to the [SFr6 million in] assets [linked to former Haitian dictator Jean-Claude “Baby Doc” Duvalier] to be able to return them to Haiti and I’m pretty sure this will be possible under the new law.

But the law won’t make it easier for victim countries to trace and locate stolen assets and that’s still a major issue not just for Switzerland but for any financial centre or developing country looking for these assets.

swissinfo.ch: But the authorities claim that Switzerland has the most stringent customer rules on the planet which make it extremely successful in tracking funds.

D.T.: I have been working in about ten countries during my professional career and each one argues that it has the most stringent rules.

I think Switzerland has an adequate system but not the best in the world. We also have to see that the system has to be constantly improved as criminals are using more and more techniques to conceal their assets.

swissinfo.ch: Exactly. Despite these tough rules, Ben Ali, Mubarak, Gaddafi and others have managed to conceal millions.

D.T.: Potentates have all the support and professional advice they need to conceal the true origin of assets and so it’s realistic to assume that in the future money will be found in Switzerland. But the fact that it’s discovered and dismantled is actually a positive sign that the system is working.

But I think it’s a very good decision by the Swiss Financial Market Supervisory Authority (Finma) to open an enquiry and to look at each and every individual case to see if the banks have applied current regulations.

Should it become evident that many banks haven’t complied with regulations, we’ll have to ask whether it’s been properly enforced. For a few years there has been very little attention given to this topic by the supervisors. On paper everything was fine, but the recent financial crisis gained much more attention.

Switzerland froze assets linked to Tunisia’s ousted president, Zine el-Abidine Ben Ali, and about 40 people in his entourage on January 19, less than a week after he was toppled from power.

Swiss officials estimate Tunisian government officials placed some $620 million (SFr555 million) in Swiss bank accounts.

In February, Switzerland froze assets belonging to Hosni Mubarak of Egypt and his associates. Mubarak’s worth remains a mystery, but claims that he and his sons amassed up to $70 billion helped drive protests that brought him down.

In both cases, the money is frozen for three years. If the illicit origin of the assets is proven within that time, Swiss authorities and Egyptian and/or Tunisian authorities will have to then define a pattern for restitution.

If it cannot be demonstrated within the framework of a criminal law procedure or a mutual legal assistance proceeding, the assets will have to be unfrozen.

If Tunisia or Egypt were to be incapable of successfully undertaking criminal proceedings and if the mutual legal assistance procedure with Switzerland were unable to move forward, the Federal Council could decide to apply the new Act on Restitution of Illicit Assets, which came into force in February.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.